What does La Niña actually mean?

This article is sponsored by Agfarm.

The most recent La Niña update from the Bureau of Meteorology (BOM) has a lot of people talking, but how many of us actually know what a La Niña is, and what it means for Aussie grain markets?

The El Nino Southern Oscillation (ENSO) outlook has been raised to La Niña, which means the typical climatic pre cursors of La Niña have reached their ‘La Niña thresholds’.

Despite this, the current conditions need to last for at least three months for 2017/18 to be considered a La Niña year.

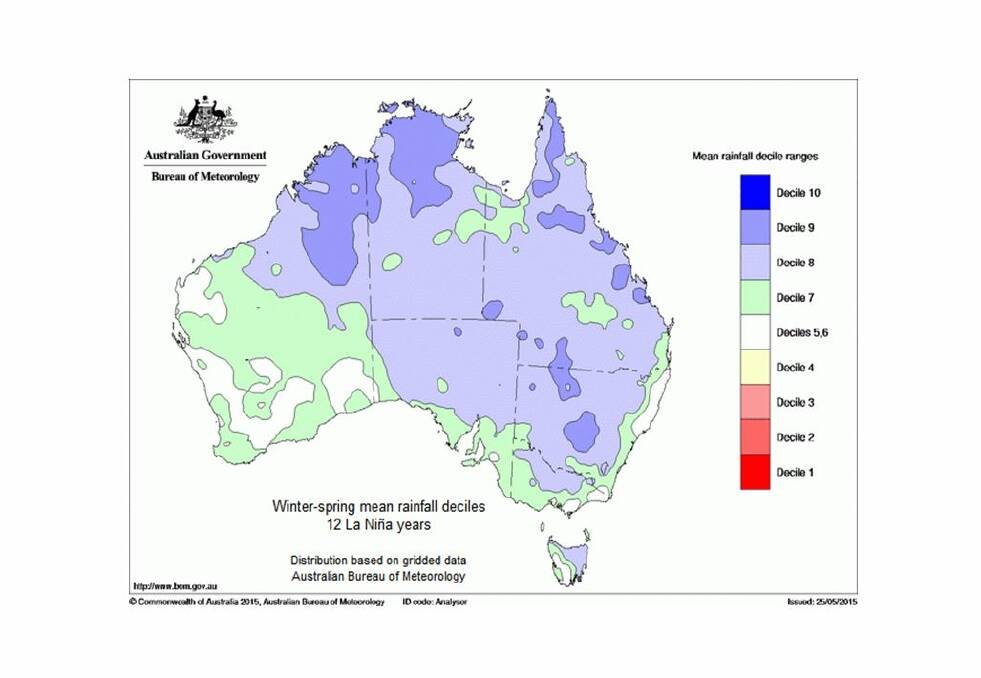

La Niña events always vary in strength and intensity, so while we can assume increased rainfall will be a possibility based on past La Niña events, the BOM has warned this event will be weak and short-lived.

BOM predict it may only persist until early autumn in Australia, and the characteristic effects of La Niña may not be felt as strongly as in past events.

How does it happen?

For a La Nina event to occur, a number of interacting climatic and atmospheric factors must be in place and be within specific La Niña thresholds.

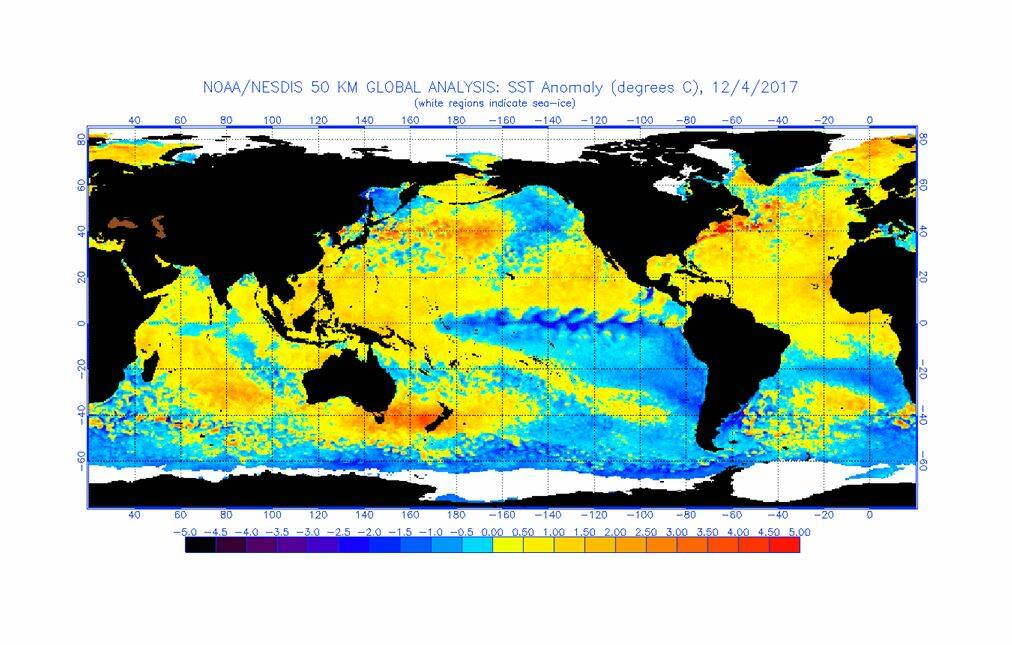

Although all of these factors interact with and influence each other, the most important indicator of La Niña is the Tropical Pacific sea surface temperatures.

Cooling sea surface temperatures in the Central and Eastern Pacific along the equator are used as the main way to identify a La Niña event forming.

Sea surface and sub surface temperatures have been cooling since the end of winter and have now broken the La Niña threshold of at least 0.8℃ below average.

All international climate models monitored by the BOM predict this cooling to continue over summer.

The other main indicators of La Niña are increased strength of the trade winds and an increase in the southern oscillation index (SOI) values.

Trade winds are winds that blow east to west across the Pacific.

During La Niña events, these winds increase in strength, blowing cloud and moving the warmer surface water west towards Australia.

When trade winds are consistently above average speeds for three or more months, they are considered to have reached their La Nina thresholds.

Average trade wind speeds are around 17-20km/hour (although this average varies between seasons). Trade winds have been showing clear La Niña patterns since the end of winter.

The SOI measures the difference in surface air pressure between Tahiti and Darwin and is a key indicator of how weak or strong a La Niña event will be.

Generally, SOI values above +7 are considered to be indicative of La Niña, and the higher the SOI value, the more intense the event will be.

The latest 30 day average SOI values are sitting at +11.1, which have recovered after dipping back into neutral ranges halfway through November.

Despite being within La Niña range, these lower SOI values, combined with cooler than average sea surface temperatures in the Indian Ocean hindering rainfall over Australia, are the main reason the BOM is predicting a weak and short La Niña.

What does it mean for Australian grain markets?

La Niña weather patterns have global effects and as such, we can expect some reaction from global grain markets to the formation of a La Niña.

Internationally, La Niña can result in milder winters in Northern Europe and the UK during their growing season.

While La Niña typically results in increased rainfall for eastern Australia, the opposite can be expected in Canada and the United States, where La Niña patterns often result in decreased rainfall and increased temperatures, particularly in south-eastern United States.

Now we have a La Niña event occurring, it will be interesting to see how international markets react.

If this La Niña is strong enough to produce a tough winter in Canada and the United States, we could see reduced wheat tonnes harvested come July – August.

This would place a floor in international wheat markets. However, a weak and short-lived La Niña will mean any price rallies in the global market (as a result of this weather phenomenon) may be short-lived.

Any rain brought on by La Niña is a bit of a double-edged sword.

It will be welcome for sorghum and dryland cotton crops in Queensland and New South Wales that have been struggling with patchy rainfall over the last few months.

However, the wet weather during winter harvest, such as the storms seen through Victoria at the start of December, have prolonged the east coast harvest and resulted in some quality downgrades.

What do we do now?

All eyes will be on the skies now that La Niña has been confirmed.

While it’s welcome news for Australian summer croppers, it does create risk for finishing Australian winter crops and recently planted North American crops.

The ensuing volatility within markets as a result of La Niña can be an opportunity if managed prudently.

There are ways to benefit from market rallies if they occur, and utilising an index selling program such as Agfarm Advantage means you are exposed to market rallies and protected from the market slumps over the period in which you choose to market your grain.

For more information on Agfarm Advantage and how it can help protect your returns, visit www.agfarm.com.au/advantage or call 1300 243 276 to speak to your local Agfarm Account Manager.

This article is sponsored by Agfarm.