FORECASTING prices is fraught at the best of times.

When the weather is one of the biggest drivers of supply and demand it makes it even harder.

Meat & Livestock Australia (MLA) are assuming a return to somewhere near ‘normal’ seasons over the coming four to five years and with it, tighter cattle supply.

We know that unlike the lamb and sheep market, where price usually has a pretty good relationship with supply, the cattle market has more factors.

With Australian beef competing in international markets cattle and beef prices in competing countries impact our price.

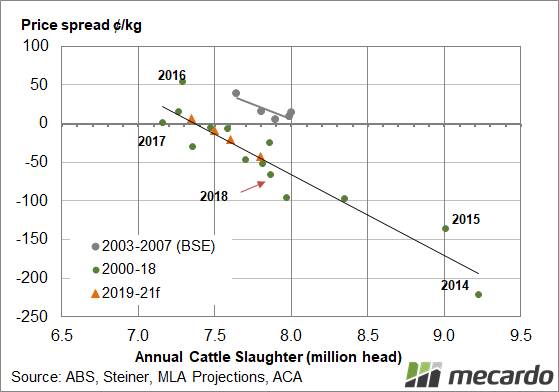

A few years back we found a relatively strong relationship between Australian cattle slaughter, the price of beef exported to the United States, and the Eastern Young Cattle Indicator (EYCI).

The basic premise is that the stronger slaughter is, the lower the EYCI is relative to the 90CL Frozen Cow Beef price.

Manufacturing beef such as 90CL is one of our biggest beef export markets, so it makes sense that the price of this has an impact on cattle prices at saleyard level.

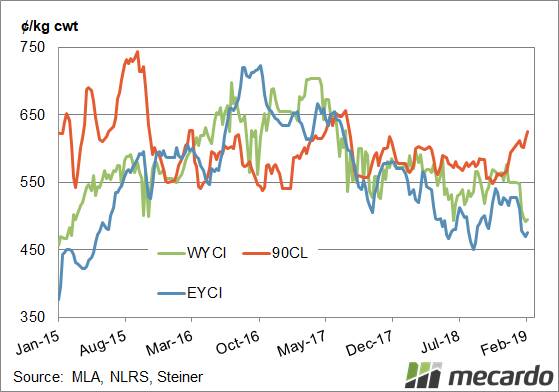

Recent weeks show cattle prices at their largest discount to the 90CL since 2015 (Figure 1).

2018 has ended close to the predicted discount, with slaughter of 7.86 million coinciding with a 66¢ discount for the EYCI to the 90CL.

It’s a long way back for both slaughter and the average EYCI discount this year.

MLA’s slaughter forecast of 7.6 million should push the EYCI to a 20¢ discount to the 90CL.

For the low slaughter in 2020, the EYCI discount should shrink to 9¢. Rising slaughter in 2021 and 2022 should see the discount widen out again.

What does it mean?:

In 2016 rampant restocker demand pushed the EYCI to a premium to the level predicted.

Whether this is repeated remains to be seen, but while the 90CL is strong, there is plenty of upside if MLA’s slaughter forecasts come to fruition.