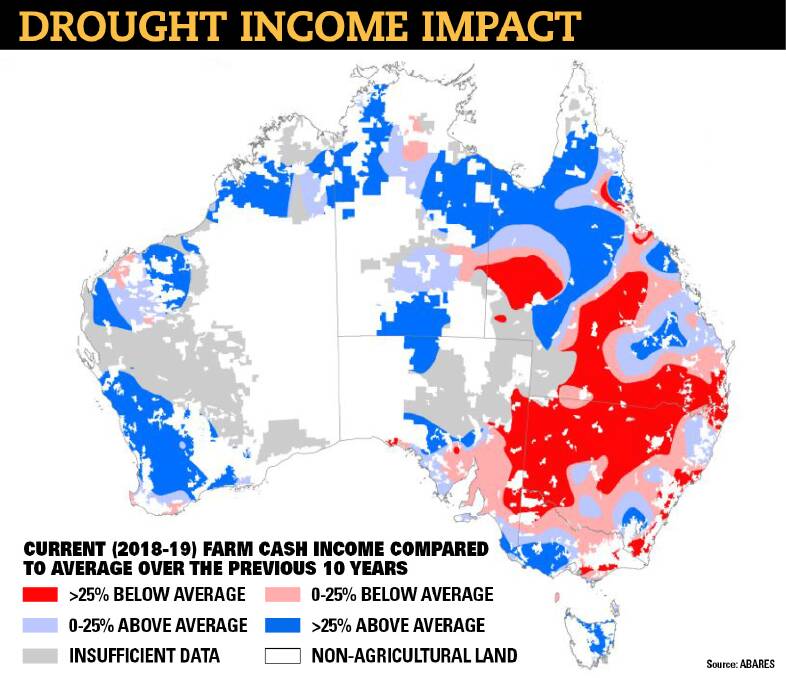

The wearying eastern states drought has not necessarily been the income killer which might have been expected for a considerable number of Australian farmers.

While crops have failed, livestock feeding is in full swing, and farm cash incomes have crashed at least 25 per cent below 10-year averages over vast swathes of Queensland, NSW, Victoria and South Australia, farm returns are actually well above average in big portions of the drought states this financial year.

More significantly, in West Australia, where late winter rainfall saved the season to deliver a bumper harvest and good grazing conditions, 2018-19 earnings are generally headed for more than 25pc above average.

Stock feed, wool to rescue

Latest survey feedback to the Australian Bureau of Agricultural and Resource Economics and Sciences shows while incomes will fall on about half of all Australian farms in 2018-19 due to drought, stock feed demand has revived earnings for those fortunate enough to supply the market.

Robust wool and sheep meat returns have also helped to significantly bolster farm earnings, even in areas caught in drought.

ABARES said the financial impact of the big dry and recent huge floods in northern Queensland was still beyond doubt, and reflected in faltering Australian export figures and a 0.2pc cut to the nation's gross domestic product (GDP) for 2018-19.

Ag's good money zones

However, grain and mixed farming enterprises in Western Victoria, Central Queensland, south eastern SA and the Eyre Peninsula, and almost the entire WA cropping belt, were notable beneficiaries from heady fodder and grain returns.

For example average Victorian mixed enterprise cash receipts for 2018-19 were now forecast at just over $400,000.

That’s marginally better than 2017-18, and almost $100,000 better than 2013-14.

"Sheep producer incomes are now higher than at any point since the wool reserve price scheme collapsed in 1991," ABARES chief commodity analyst, Peter Gooday, told this week’s Outlook 2019 conference in Canberra.

Best performing sheep income zones included NSW tablelands areas, western Victoria, Tasmania and SA’s south east.

Beef good news, too

Beef earnings were up in many regional areas, too, even though cattle prices had been coming down.

Even beef cattle operators paying increasingly steep fodder costs (up almost 50pc in NSW in 2018-19), or selling at lighter weights, had achieved better overall enterprise returns than in 2017-18.

As the drought intensified they had turned off more stock this financial year, or were paying less to buy in store cattle for fattening.

Beef business expenses such as maintenance had also been reigned in as seasonal conditions dried out.

For different reasons the beef, wool, barley and fruit and nut sectors would be agriculture’s biggest production income performers this financial year according to ABARES.

The dairy industry would be the biggest loser.

Its problems are largely related to a massive jump in feed costs, but also lean farmgate prices.

NSW dairy falls 66pc

Average dairy farm incomes were expected to be down 44pc in Australia in 2018-19, ranging from a 66pc fall in NSW to SA farms recording a 24pc drop.

Tasmania was the only state with positive farm income, up 7pc.

Nationally, average dairy business profits have slumped to their second lowest point in 20 years as feed and water costs in eastern Australia blow out, especially in NSW and Queensland.

It is clear the ongoing drought in the eastern states and Queensland floods have devastated those affected

- Peter Gooday, ABARES

Mr Gooday said feed costs on NSW farms would be up by an average $108,000 this financial year, to about $350,000.

“But unlike sheep and beef producers, dairy farms have not had a run of sustained price increases for their production which makes it more difficult for them to weather the high stock feed price costs,” he said.

Milk earnings vs costs

Subsequently only two thirds of the milk produced on Australian dairy farms was covering enterprise running costs, including financial repayment costs.

That compares with an average since 2001 of 77pc of milk output covering production costs.

RELATED READING:

Meanwhile, ABARES has made a sobering prediction for dairy farms in NSW and Victoria hoping for price relief on irrigation costs when the drought breaks.

Water costs would generally become more consistently higher than the past decade due to increasing rainfall variability and more demand from permanent horticulture and other crops.

“It is clear the ongoing drought in the eastern states and Queensland floods have devastated those affected,” Mr Gooday said.

However, thankfully improved commodity prices had helped some, including those with below average harvest yields, or grain stored from previous seasons when prices were so disappointing.

“Grain prices are expected to increase an average 11pc in 2018–19. Wheat prices rose 5pc and barley prices by 16pc,” he said.

Scale helps

The advantages of scale and geographic diversity to help survive seasonal variability were also hard to ignore, said ABARES executive director, Steve Hatfield-Dodds.

Productivity growth was driven by large farm operations which enjoyed better overall returns from their access to good technology and management skills.

ABARES calculated Australia’s biggest beef producers with more than $5m in sales in the past five years averaged 9.2pc rates of return, including capital appreciation.

That was more than double the beef industry average of 4pc.

In comparison, small scale beef farms with less than $500,000 in sales averaged just 2.6pc return, while those in the $500,000 to $1m sales category had achieved 4.6pc and larger.

Dr Hatfield-Dodds noted in 1979 farms with receipts equivalent to more than $1m a year today represented just a few percent of Australia'[s total agriculture sector, but today were about 18pc.

Back 40 years ago those bigger performing enterprises occupied 45pc of the farmland area, but today farmed almost 65pc.

- Does this article interest you? Scroll down to the comments section and start the conversation. You only need to sign up once and create a profile in the Disqus comment management system for permanent access to all discussions.