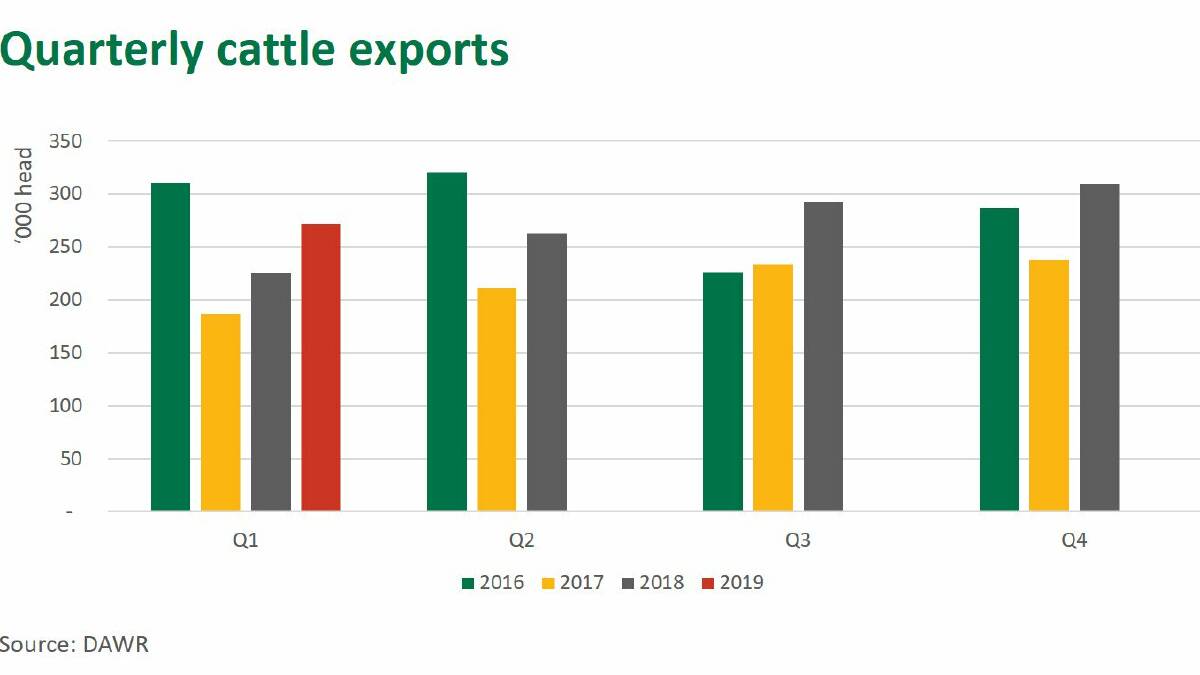

Live cattle exports have gone gangbusters for the first three months of the year, up 21 per cent year-on-year to 271,000 head.

Meat and Livestock Australia said the hike has been driven by increased shipments out of Townsville and Portland and the commencement of exports from Alma (Rockhampton).

Cattle shipments from Darwin have had a slower start to the year, back 14pc at 78,000 head, MLA said.

Latest MLA market data shows that Indonesian cattle imports from Australia jumped 26pc year-on-year in the first quarter of 2019 to 142,926 head. However, shipments were well below 2016 levels.

In the 12 months ending March, Indonesian cattle imports from Australia totalled 618,754, up 22pc.

In contrast to Indonesia, whose imports are dominated by feeder cattle, Vietnam imported 207,492 head of Australian cattle in the year to March with the bulk for slaughter.

Vietnam is easily our second biggest market for live cattle, taking almost 50,000 head in the first three months of 2019.

Other major buyers in the first quarter of this year have been Israel (25,024, up 119pc), China (21,053, up 7pc) and Russia (13,696).

Meanwhile, national slaughter rates have been elevated throughout the start of 2019 and have exceeded 2016 levels due to ongoing drought in key cattle-producing areas, MLA said.

Despite recent rain across north and central Queensland, poor pasture conditions saw increased numbers of store cattle hit saleyards across the eastern states earlier this year, keeping prices suppressed.

In comparison, live export prices out of Darwin found strong support and were at a premium to southern markets for much of the first three months.

As such, Darwin export prices were now in line with southern markets. The Darwin export feeder steer tracked at a 50-70c a kg live weight premium to the Queensland saleyard feeder indicator in the first three months of 2019 but that difference has closed to an average one cent so far in April, MLA said.

Price spreads between northern and southern markets are normal over the northern wet season but not often as large as recorded this year.

Looking ahead, MLA said supply and price would be largely dictated by rainfall and the degree of restocker demand.

Parts of Queensland have had good falls in recent weeks but the tail end of the northern wet season doesn't show much promise.

Meanwhile, southern Queensland, NSW and Victoria were all awaiting autumn and winter rainfall. The latest three-month BOM outlook was fairly neutral for southern Australia.