Earlier in the year, Mecardo made the not so bold prediction that mutton prices would hit new records and indeed it has.

The last month has seen sheep slaughter on a downward trend but it seems to have found a base for the time being.

READ MORE:

Given the very strong sheep supplies last August, it shouldn't be that surprising that things are now tightening up.

There is little debate of where sheep supply is headed in the coming months.

The lows of last July are the initial target but it's likely to surpass that and go towards 2010-11 levels.

Almost all the mutton produced in Australia is exported. As such, mutton prices are almost solely driven by supply and export demand.

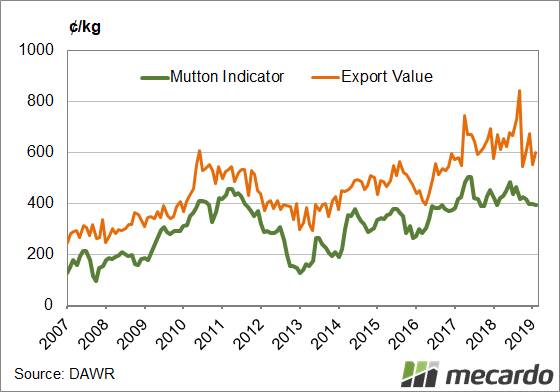

The maximum export value, or the maximum average price export markets have paid, hit 846 in September 2018.

During the tight supply period of 2010 and 2011 mutton prices moved to just a 20 per cent discount to mutton export values.

In January and February this year, mutton averaged a 45 per cent discount to the export value (Figure 3).

From current mutton prices of around 550, a 20 per cent discount would put export values at 660/kg swt. There is every chance current export values are there already.

What does it mean?

Mutton export values will have to rise further to see mutton prices continue to rally.

There will come a point where processor margins become too negative for processors to continue, and demand will weaken.

Current mutton prices look close to a sustainable level, but 600 will start to put some pressure on.

Given the impending flock rebuild, it's hard to see higher prices pulling too many more sheep out anyway.

There might be another 10 per cent upside for mutton during the winter, but further upside seems unlikely.