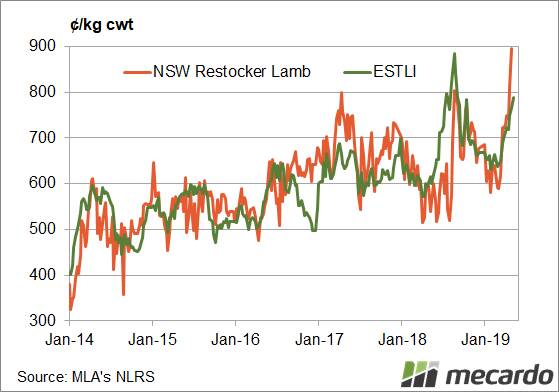

All lamb prices are streaking upwards, but some are higher than others, in a relative sense.

The NSW Restocker Indicator has moved well ahead of the ESTLI, setting a new record, just shy of 900c/kg cwt.

Strong forward lamb prices and weakening grain prices are no doubt adding confidence for restockers, who are buying lambs up to 24 kilograms cwt.

READ MORE:

In dollar a head terms, a 35kg lamb is making $147 a head, including a $5 skin.

Even earlier this year $150 was a good price for trade lambs, so it must be tempting for producers to flick unfinished lambs for a similar price.

For buyers, it would be a little scary to spend so much money on lambs, but the potential gains are large.

Trade lamb prices have broken through 800c, with many pens making 850c. With forward contracts on offer at 830c/kg cwt, restocker buyers are banking on 830c or more.

The gross margin on lambs, even when paying record prices, has never been better.

Every kilogram gained is adding $3.50-$4 a head, and even at high grain prices this will cost just $2-$3 a kilogram. Hence lamb feeders can expect to make money with finished lamb prices as 'low' as 750c/kg cwt.

If prices reach new records, expensive lambs bought now will return some exceptional margins, which equate to a 22 per cent return.

What does it mean?

Crunching the numbers show just why restocker lambs are making such good money at the moment.

It also highlights the opportunities which can be realised in a lamb finishing system in the coming two to three months.

The main risk comes from weakening demand in the form of processors cutting shifts in response to tight margins.