Fonterra is cutting its stake in Chinese infant formula manufacturer Beingmate.

Chief executive Miles Hurrell announced on Wednesday the company had been unable to find a buyer for its whole stake in Beingmate.

"As a result of this, we are now considering selling part of our holding and, as required by local listing rules, need to pre-announce our intention," he said.

The sale follows Fonterra's dismantling of its arrangements with Beingmate, which Mr Hurrell described as disappointing.

Fonterra's stake in Beingmate was part of a deal it struck with China's biggest infant formula company in 2015.

Under the joint venture, Beingmate acquired Fonterra's infant nutrition and milk powder plant at Darnum in Victoria and distributed product through Beingmate's 80,000 retail outlets in China.

Fonterra invested about $NZ754 million in Beingmate in the deal.

But after losses in 2016 and 2017 and only a small profit in 2018, Fonterra started to unwind the venture.

It brought the distribution of its Anmum product in China back in house and ended the Darnum joint venture, buying back its share of the facility.

Mr Hurrell said Fonterra regarded its investment in Beingmate now as a financial investment only.

Subject to demand for the shares, under the Shenzhen Stock Exchange market rules, it is only possible to sell 1 per cent every 90 days directly on the exchange or sell up to 2pc in a single block every 90 days.

Trades greater than 5pc can be made to an individual party in an off-market transaction.

TasFood acquires Betta Milk

TasFoods Limited last week completed the acquisition of the milk processing assets and brands of Betta Milk.

Betta has market shares of 17 per cent of Tasmanian fresh milk sales and 37pc of branded milk sales.

"This is an exciting day in the journey of TasFoods' growth strategy," TasFoods executive chairman Shane Noble said.

"The acquisition of Betta Milk will be transformational for TasFoods and will enable us to leverage our existing resources and facilities.

"Betta Milk has excess production capacity that presents multiple avenues for growth with Tasmanian, interstate and export markets."

Keytone Dairy acquires Omniblend

Keytone Dairy Corporation last week completed the acquisition of leading Australian manufacturer of health and wellness dry powders and ready-to-drink UHT dairy products Ombiblend.

Keytone said the acquisition would enable it to fast track its development.

Omniblend holds numerous accreditations including from the Chinese Certification and Accreditation Administration.

The required $18 million in funding was raised in full.

Keytone chairman Peter James said the acquisition has received overwhelming support through the capital raise and shareholder approval process.

It provided Keytone with a strong growth into the health and wellness sector and offered an early mover advantage into Asian markets, particularly China.

Omniblend has been involved in a number of significant developments in recent months, including:

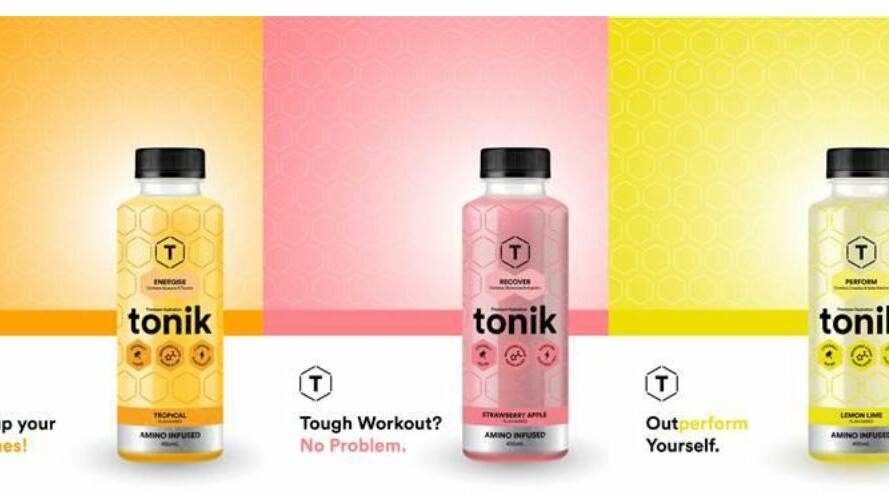

- Its branded functional lifestyle beverage Tonik securing national ranging with Metro Petroleum station.

- Work starting on the integration of its manufacturing sites into one large-scale powder-manufacturing site.

- Entering into an exclusive agreement with one of the world's leading protein brands for a new range of ready-to-drink products.

- Dispatching its first product for the Endota Spa network.

This story first appeared on Australian Dairyfarmer