CHATTER from participants in the Wagyu industry suggests that premiums for the breed are returning to the market. While historically Wagyu F1 steers always enjoyed a healthy premium over the Eastern Young Cattle Indicator, the flood of Wagyu cross activity saw the premium fade away during the 2018 season, according to data from AuctionsPlus sales.

The presence of quality breed branding doesn't always carry a premium attached. This is a lesson, for not only the Wagyu industry but other cattle breeds that command a premium such as Angus.

Australian Wagyu beef production has seen consistent growth in all categories. These categories are fullblood and purebred or crossbred, destined for either domestic or export beef markets. However, it was in 2015 that the Australian Wagyu sector experienced a real flush of rejuvenation.

What drove this was a combination of increased competitiveness in exports and the entrant of new major buyers in the market, adding pressure to supply. Producers responded to these promising signals, with seedstock markets receiving simultaneous growth and rapid expansion of Wagyu herd sizes.

The latest projections estimate that Australian Wagyu production will reach 74,000 tonnes in 2022. Given the last reported production estimates for Wagyu were 30,000t in 2017, this is a significant trajectory. That being said, over the 2015-2018 period the number of Wagyu crossbred joinings increased by an estimated 89 per cent according to Australian Wagyu Association (AWA) survey results.

In 2017, total Wagyu joinings were estimated at 300,000, while fullblood/purebred accounted for about 75,000, or 25pc of the total. At the time, Meat & Livestock Australia/AWA production modelling anticipated a rise in joinings to 760,000 over four years. The predicted growth rate in joinings is likely to be reduced, however, thanks to the lower premiums received for Wagyu F1 feeders in 2018/19 and high grain prices.

Disappearing premiums not just a supply story

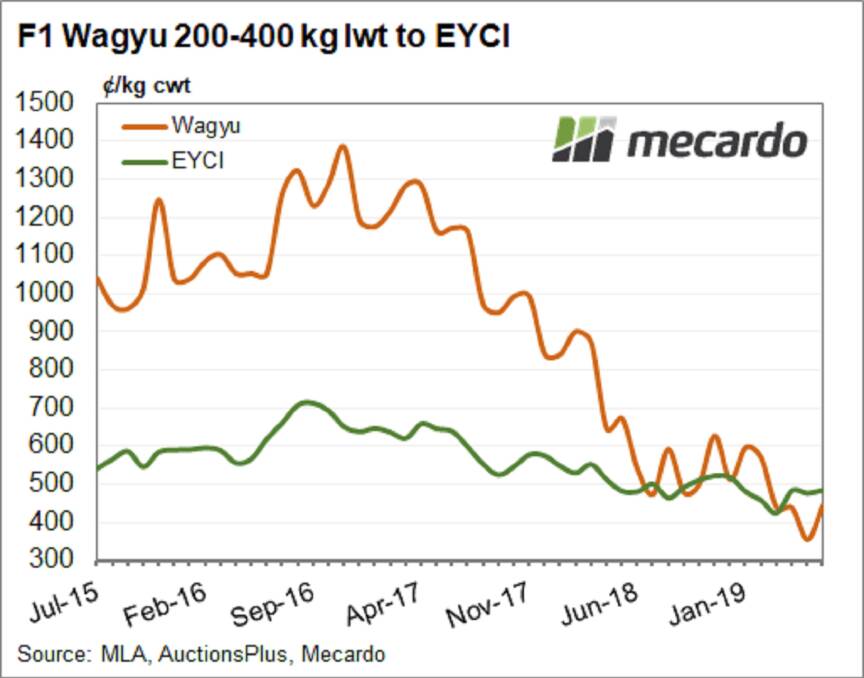

AuctionsPlus F1 Wagyu steers weighing between 200-400kg live weight follow a similar price movement to the EYCI over time. Understandably, Wagyu steers usually command a healthy premium over the EYCI in the normal range of 20 to 95pc. However, over the 2017 season, the annual average Wagyu premium spread over the EYCI narrowed from 85pc to 78pc. In October 2018, the Wagyu premium fell away again to a discount for the first time of 2pc to the EYCI.

An obvious logic behind the falling Wagyu premium levels would be the flood of Wagyu cattle hitting the market. However, analysis of monthly and quarterly volumes trading on the AuctionsPlus system doesn't appear to suggest the decline in the Wagyu premium over that period was volume related, although there is plenty of anecdotal evidence to suggest that F1 Wagyu numbers being sold direct have grown.

In the second half of 2018, there were a few times when the F1 Wagyu price managed to gain some ground on the EYCI, reaching toward a 30pc premium spread but it could not be maintained for long. In recent months, the F1 Wagyu on AuctionsPlus has been running at a discount to the EYCI. For the past four months, it has averaged a price of 427/kg cwt compared to an EYCI average of 475 over the same time horizon.

Further to this, analysis of the percentage spread premium/discount highlights the failed efforts of the F1 Wagyu to break back into the 'normal' historic spread zone between 20pc to 95pc. In May 2019, the F1 Wagyu spread dipped to a record low of a 26pc discount to the EYCI before recovering toward a 10pc discount most recently.

While the data would suggest the Wagyu premium has disappeared for now, the same can't be said for all premium cattle types. Since 2015, 100pc Angus breeds on AuctionsPlus have held an average premium of 25/kg lwt (or 8pc on a percentage spread basis) over non-Angus breeds. The first four months of 2019 saw the premium average 35/kg lwt or 13.6pc.

The Wagyu marketplace has changed

The AWA website notes that "Wagyu F1 sales reported by AuctionsPlus represent a small proportion of total Wagyu F1 sales and that the data listed may not reflect direct supply relationships".

AuctionsPlus CEO Angus Street confirms that many vendors selling via their platform during the 2015-16 seasons did not return to the platform as the spread deteriorated during the 2017-18 period. This suggests the more recent F1 Wagyu data is reflective of a different marketplace to the one that was being reported a few years earlier.

Several Wagyu industry participants have suggested that using direct sale channels it's not uncommon to see F1 Wagyu cattle achieving a carcase weight price between 650-750 currently. This would equate to a 30-45pc premium above the EYCI.

Anecdotally, the industry talk suggests that the F1 Wagyu lines making their way to the AuctionsPlus platform are the ones that are unable to achieve the prices producers want through the direct channels. This poses a bit of a problem for the industry and for a company that thrives on data to explain market dynamics.

If we're to believe what we hear, it seems to be more of a data problem rather than a Wagyu problem. Evidence suggests that the only available data isn't reflective of the wider Wagyu industry with AuctionsPlus Wagyu data accounting for less than 5pc of market volume. This limits the ability of participants to make informed marketing and production decisions.

With the increasing demand for Australian beef from the rising affluence of customers in Asian markets, the opportunity for premium Australian product is on our doorstep. It may be time to consider a more regular, wider data capture of the Wagyu sector and more frequent reporting of some key metrics based around price, supply and demand.

The provision of greater data-driven insights is an initiative that the Wagyu sector would greatly benefit from if it is to compete against other prime beef products and take advantage of the opportunities in these growing overseas markets.