Financial assistance for Australians in remote locations should be wound down or cancelled, according to the Productivity Commission.

The independent advisory body released its draft report into remote area tax concessions and payments last week, which was commissioned by the federal government.

Tax concessions for designated 'isolated areas' were introduced in 1945 to address remote hardships and inequality with urban areas, and to promote regional development.

The PC said governments of all levels have a long history of supporting remote communities, which exert "continued pressure to help sustain their long-term viability and prosperity".

But times have changed, modern technology has made life easier and support should be wound back.

"Remote area tax concessions and payments are outdated, inequitable and poorly designed.

They should be rationalised and reconfigured to reflect contemporary Australia," the PC report said.

"Some places that were undeniably remote in 1945 have since become more developed and connected to the rest of the country and the world.

"Further, technological and economic developments have cushioned many of the difficulties stemming from distance, isolation, and a harsh climate."

There are three assistance measures for remote and certain regional residents the Zone Tax Offset, the remote area allowance, and the fringe benefits tax remote area concessions.

According to the PC, the market has responded to the difficulties of attracting labour, they don't encourage people to live or work in remote areas, and it is available to some areas that are no longer isolated.

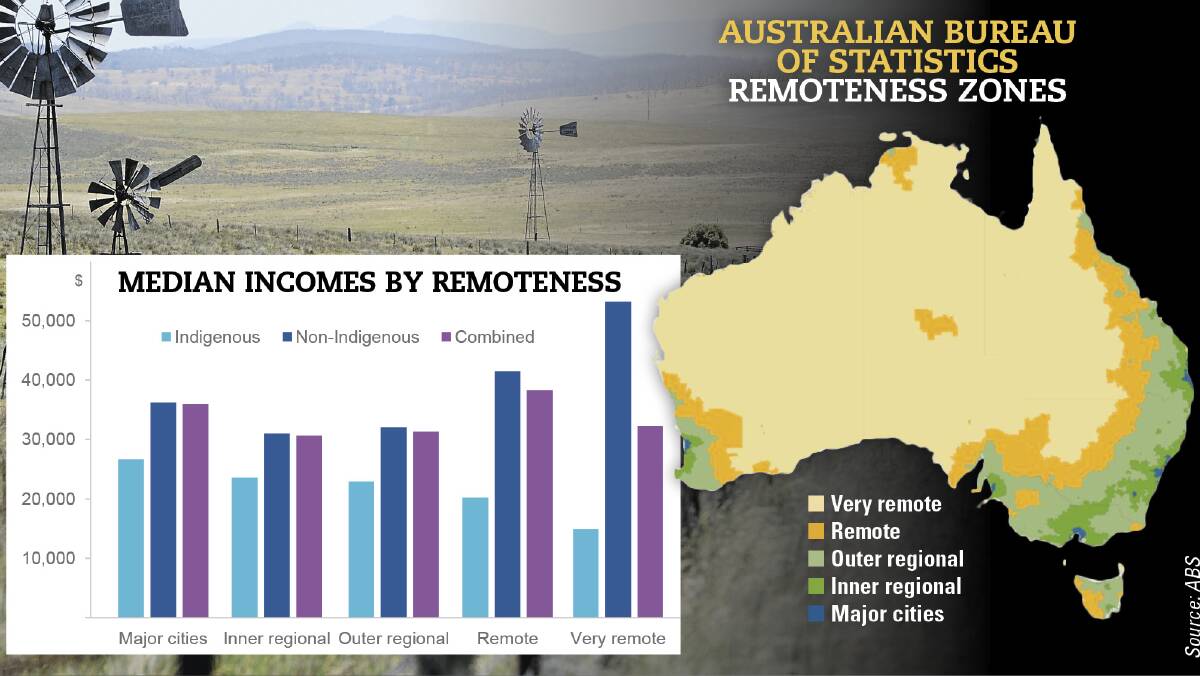

"Higher wages in the zones across a wide skill spectrum suggests that the market compensates workers, at least to some extent, for the disadvantages of remote living," the PC said.

The PC said zone tax offsets, which are claimed by 480,000 people or 3 per cent of taxpayers, should be scrapped. Residents of Zone B get a $57 tax offset, and more remote Zone A residents get $338 and particularly remote Special Area residents receive a $1173 rebate.

About half the claimants live in the four largest cities in the remote zones -Townsville, Cairns, Darwin and Mackay - and almost 40pc Northern Territory residents. About 60pc of Zone Tax Offset recipients earn more than the median wage.

Remote concessions for Fringe Benefit Taxes are designed to create a more level playing field but the system is complex, poorly targeted, overly generous and while state and territory governments argue that it promotes regional development - the geographic zoning is too broad to drive growth into areas of remote need, the PC said.

The concessions exempts from taxation housing that is provided to an individual by their employer. It is estimated to be applied to as many as 46,000 homes in remote areas and cost the tax system between $210m and 430m a year.

The Remote Area Allowance was introduced in 1984, to help people meet the higher costs of living in remote areas. Current fortnightly payment rates are $18.20 for an individual, $15.60 each for a couple, and $7.30 for each dependent child. The payments have not increased in the past 20 years.

It cost about $44 million in 2017 and more than half (41,000) of the estimated 76 000 current recipients of the RAA, the majority are located in the NT.

The PC said the government should review the Alloance's payment rates, transparency, and outdated geographic boundaries which currently include some areas that are not as isolated as they once were.

Treasurer Josh Frydenberg welcomed the PC's draft findings and said he expected the final report in February next year.

"The Productivity Commission has already engaged widely with stakeholders, including in a number of regional areas and the Government encourages interested stakeholders, particularly those in regional Australia, to remain engaged in this further consultation process," Mr Frydenberg said.

Labor's financial services spokesman Stephen Jones said the government was "in hiding" and called on Coalition ministers to respond to the PC's report.

"It has been a week since these major changes were flagged, yet we have heard nothing from the relevant Melbourne-based Ministers, Treasurer Josh Frydenberg and Assistant Treasurer Michael Sukkar," Mr Jones said.

"Labor understands that Australians living in regional and remote communities face very real additional costs and hardships".