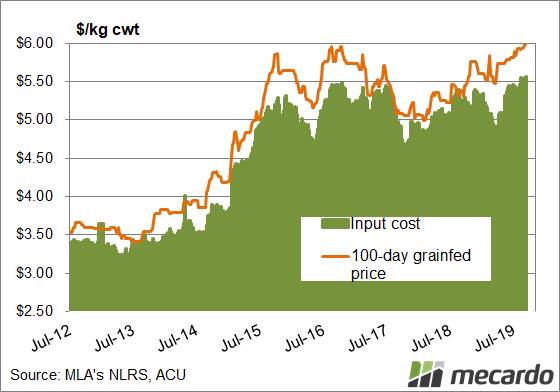

STRONG export demand, a weaker Australian dollar and tight supplies of grass finished cattle has seen the Queensland Over the Hooks 100 day Grain-fed Steer Indicator hit a new record in recent weeks.

The upward trajectory this year has taken grain-fed cattle prices from 547 in March to hit the new high of 598/kg cwt at the end of August.

The previous record grain-fed cattle price of 596/kg cwt was set back in late winter and spring 2016 when the number of cattle on feed was 788,873 head.

The fact that the new record price has been set when there are 45 per cent more cattle on feed is a testament to the increasing demand for grain-fed cattle.

Rising grain-fed cattle prices have been matched by rising input costs in the north. The Shortfed Feeder Cattle Indicator has rallied 12pc, or 37 since the end of April to sit at a two year high of 333/kg lwt.

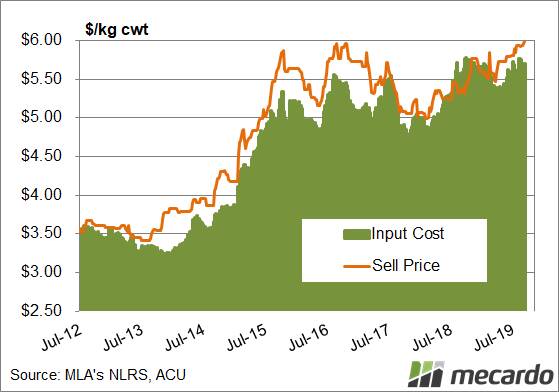

Southern lotfeeders input costs are higher, with medium fed feeders at a 10 premium to shortfed steers, sitting at 343. Cheaper feed has offset some of the rise in feeder cattle prices. In recent weeks, this has seen total input prices fall.

What does this mean?

Moves in input and sell prices have seen lotfeeder margins remain relatively steady for the last four months in both northern and southern zones. There is little room for prices to rise without a move in grain-fed cattle values, but margin pressure will start to come on lotfeeders with as little as a 10/kg lwt rise in feeder prices.