It is safe to say Australia is facing unprecedented demand for its beef.

Total Australian beef exports continue to run ahead of last year, with October exports to China almost doubling last year's levels.

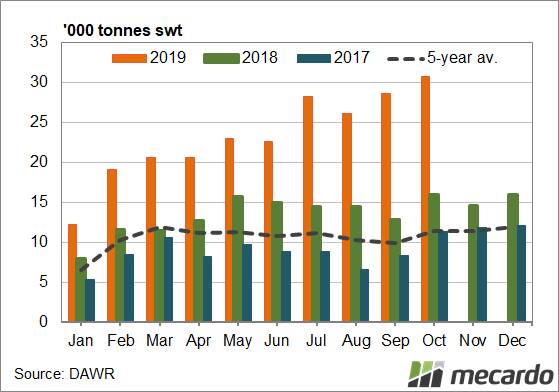

China imported 30,724 tonnes of Australian beef in October (Figure 1). This was 93 per cent higher than October 2018 and 169pc higher than the five year average.

Over the last five years, China has taken between 9-14pc of our exports, and they are now our major market.

China is also buying plenty of beef from other markets.

Steiner Consulting recently reported that year to September New Zealand exports to China were up 70pc and Uruguay up 20pc.

This beef usually ends up in the US.

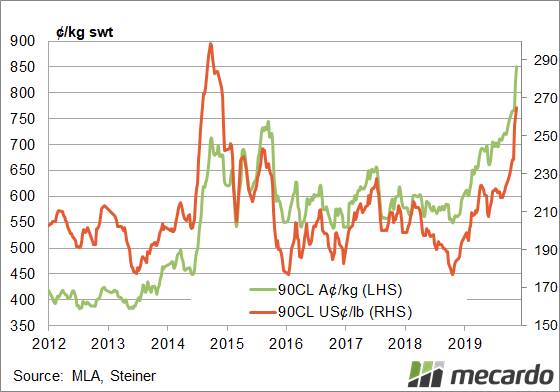

The positive impact of Chinese demand on price has continued and strengthened as we have moved into November.

US imported 90CL Frozen Cow beef prices jumped to a new record in our terms of 819/kg swt (Figure 2).

There are few prospects for increases in global beef stocks. It takes some time for cattle herds to build to a point where beef supplies can increase.

We know what is going to happen to Australian beef supplies if and when it rains.

As such, Steiner is reporting a level of panic buying in US and Asian markets as buyers can't see any reason for prices to stop rising, let alone fall.

What does it mean?

The stronger demand from China for beef means stronger prices.

Rising beef export prices are finally being reflected in slaughter cattle prices.

The Queensland medium cow indicator has rallied sharply in recent weeks, while heavy steers moved within a whisker of a record.

If beef demand remains strong, these prices will look cheap.