In United States dollar terms, Chicago Board of Trade wheat futures prices are not high. In terms of the past four-and-a-half years they are in the upper band of prices, sitting between 500 and 550 US cents a bushel. However, longer term back to late 2006, current prices are still at the lower end of the trading range.

A part of this may be currency related, with a stronger US dollar keeping some pressure on commodity prices in $US terms. However, it is also a function of high global stocks and limited opportunity for the US to export enough wheat without seeing their own stock levels building.

This backdrop is important as we enter the 2020 production year. The foundations for next year's global crop are being set now, and they are shaky. If things don't stabilise CBOT wheat futures may break out of their malaise and get back into the territory visited in 2010 to 2013, in excess of 600 USc/bu.

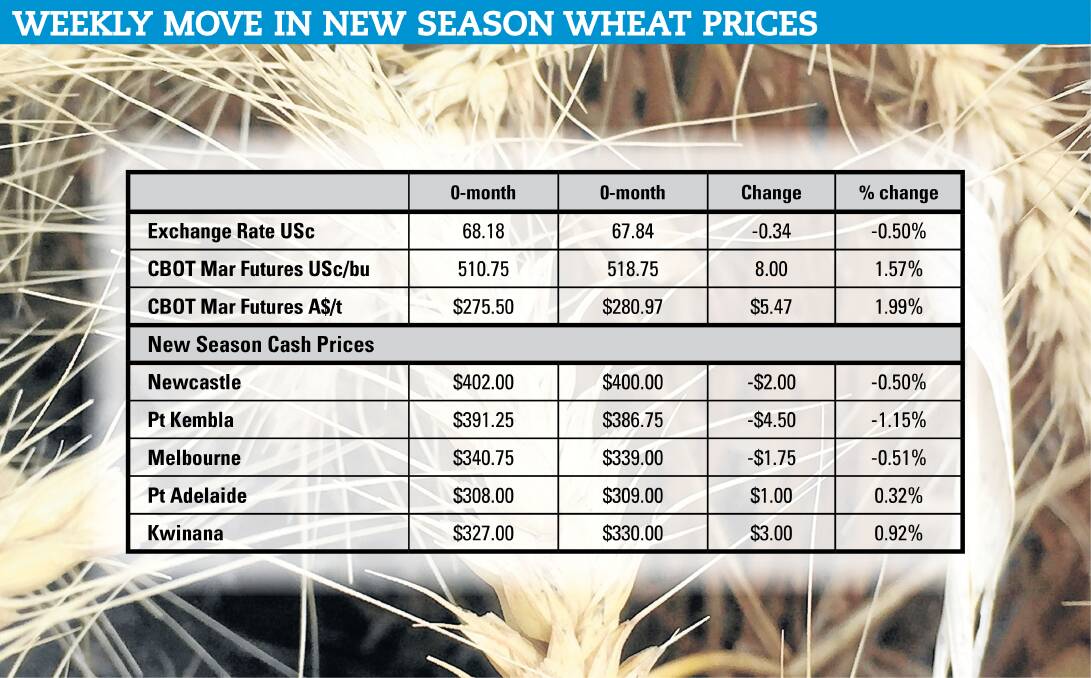

That gives us some food for thought in terms of where Australian wheat prices might head during 2020. If our dollar stays around 68 US cents, a futures price of 600 USc/bu translates into $A324 a tonne, which in turn should support cash prices delivered port of around $345/t ($365/t in WA).

So, why are the foundations of next year's crop shaky? It is basically all about the newly planted northern hemisphere winter wheat crop. This is the largest part of the global crop and is also higher yielding that most spring planted wheat crops.

Too many areas have had an early onset to winter, or very wet conditions, or very dry conditions. It is hard to find a sizeable portion of the northern hemisphere winter wheat crop that is establishing under ideal conditions.

In the US wet conditions and delays to the corn and soybean harvests have prevented some areas from being planted. Meanwhile, in Kansas and further south, there are reports that conditions are very dry.

In Europe wet conditions are preventing wheat from being planted in the UK and France. In France only 74 per cent of their crop has been planted versus 97pc normally. There is now a warning that not all the crop will be planted. It is similar in the UK and, although crops may still be planted if things dry out, yield reductions are expected.

In Russia, dry conditions have enabled a record crop to be planted, but that dryness is impacting the establishment and development before winter.

If the northern hemisphere winter is as severe, and as long, as some are now forecasting, the spring growing season may be off to a late start, further pressuring the winter crops, and spring plantings.

- Details: 0411 430 609 or malcolm.bartholomaeus@gmail.com