AUSTRALIA’S main competitor for lamb, New Zealand, continues to see supplies decline. The number of ewes joined has fallen 2 per cent to 17.375 million head. This was only partly compensated for by better lambing percentages.

The Kiwi’s lambing percentage went from 127.3pc in 2017 to 129pc in 2018. This easily outstrips Australian lambing percentages, which at their best for crossbred ewes sits at only 110-115pc on a nationwide scale.

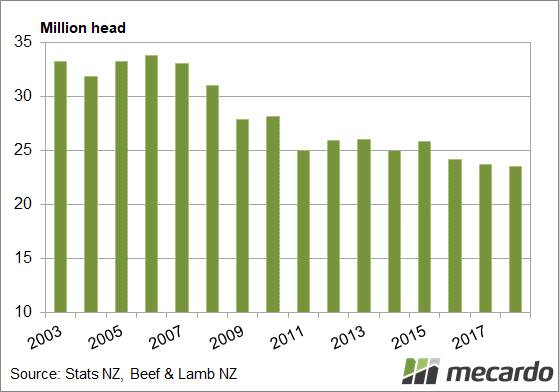

In 2018, the NZ lamb crop fell 0.7pc to a 64 year low of 23.515 million head. Over the course of the last fifteen years, the New Zealanders have cut the number of lambs marked by 29pc, or 9.7 million head.

Increasing productivity has seen NZ lamb slaughter fall by 21pc over fifteen years. This has actually been more than matched by a 35pc increase in Australian lamb slaughter. The total lamb slaughter for the two countries is up by around 1 million head over fifteen years.

We know that this year any decline in NZ lamb slaughter is likely to clash with lower supplies from Australia. However, 69pc of NZ lambs are slaughtered between December and May, so the coming months will provide the most competition for our lamb exports.

When in the next 3 to 4 months NZ lamb supply hits is hard to say. The five-year average shows most come in the January to March period, but last year supply was more evenly spread through to May.

What does it mean?

New Zealand lamb slaughter is likely to be slightly lower this year, providing a little less competition in our export markets. Most of New Zealand’s lambs are yet to hit the market, however, and might limit price upside, especially for export lambs over the coming months.

May to July could again be the really troublesome months for world lamb supplies when New Zealand tapers off.