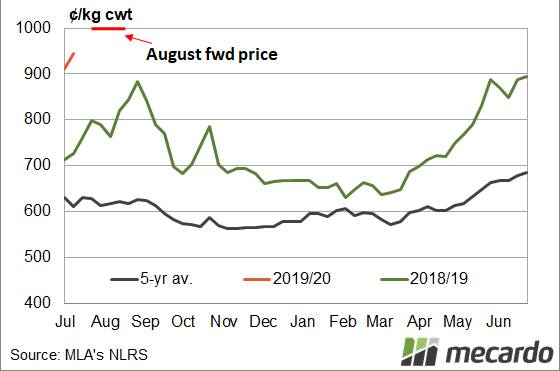

REMEMBER last year when lamb prices moved through 800 and we thought it couldn't go much further? Last week the Eastern States Trade Lamb Indicator (ESTLI) reached 945, but at least one buyer thinks prices are headed higher.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

There are reports of forward contracts for August being offered at the magic 1000/kg cwt, but will the market get there? These extraordinary price levels

are no doubt driven by the expected dearth of spring lambs and a desire to ensure some supply.

The forward prices look very strong against the trade lamb prices (Figure 1).

Come August, the grass will be growing in regions lucky enough to have had winter rains. There will be a temptation to hold lambs for more weight gain but this comes with significant risk. A 22kg lamb at 1000 is worth $220.

Hold until mid-September, and the lamb will weigh 26kg cwt with good growth rates. To break even, the lamb will have to make 845/kg cwt. This is 15pc below the August forward contracts. This drop would be large on a historical scale, but last year we saw a 22pc fall from spring highs.

There is little doubt the strong prices will see lambs hit the market as soon as they are ready, and we are likely to see a strong price fall at some stage. The bottom will still be historically high but the economics are likely to suggest grass could be better used than putting more weight on lambs.

What does this mean?

Supply will remain tight into September as well but it's hard to know when the tipping point will come, and when it does, prices will fall quickly. If growers are confident they will have lambs ready in August, we can't make much of a case for not taking the forward prices on offer.

Start the day with all the big news in agriculture! Click here to sign up to receive our daily Farmonline newsletter.