Wool prices are crashing, and while still historically strong, last week hit one and a half and two and a half year lows for the 19 and 21 Micron Price Guides (MPGs) respectively.

The wether flock was already falling, so the combination of lower wool and strong sheepmeat prices are likely to see further declines in wether flocks.

The wether and ram flock hit a new low in June 2018 of 8.7 million head.

This fall is not just a function of the declining flock, with the proportion of adult sheep dropping from 22 per cent to 18pc over the last five years.

Strong wool prices were threatening to see the wether flock steady or grow when seasonal conditions allowed.

But the latest fall in wool prices, combined with strong sheepmeat prices, might see wether numbers continue to decline.

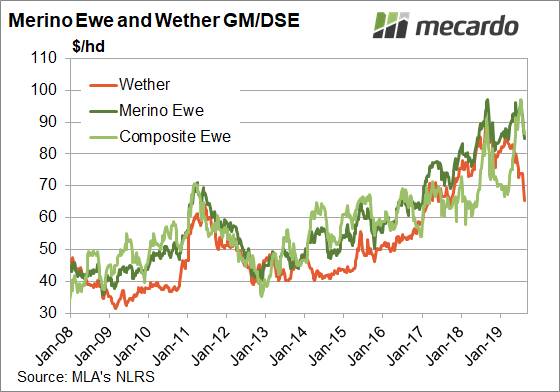

A basic gross margin per dry sheep equivalent (DSE) calculation for Merino ewes and wethers shows the spread is growing.

The latest move in the wool market has wiped $20 a head off the gross margin for wethers since the start of the year.

The Merino ewe gross margin per DSE is down $10 on this time last year, and very close to that of the start of the year.

The latest fall in wool prices and strong lamb prices has moved composite ewes back to the top of the table, but only marginally, making $3 more per DSE.

What does this mean?

Despite a lower cost of production, it's hard to see the wether flock growing with such a divide in the value of outputs.

Wether gross margins per DSE are now further behind Merino and composite ewes than they have been at any time over the last ten years.