Unusually strong mutton prices almost hit a record in Victoria.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Sheep markets have rarely been stronger and normally it's the price low that we see at this time of year.

So, should growers be selling ewes rather than lambs?

The credit for rising mutton prices has been squarely placed with Chinese demand.

Increasing demand can be the only answer when we see these kinds of price rises.

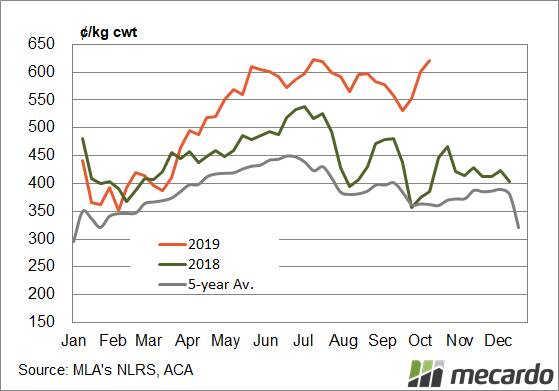

The 10 per cent rise in the Victorian Mutton Indicator from the low has been accompanied by an 11pc increase in slaughter (Figure 1).

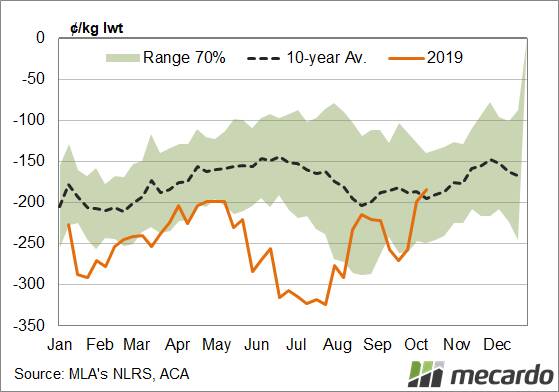

The relative price of mutton has also hit some milestones.

The Victoria Mutton Indicator recently moved to just a 23pc discount to the Eastern States Trade Lamb Indicator (ESTLI).

Mutton hasn't been this close to lamb since May 2018 (Figure 2).

As we move towards the end of spring and paddock feed supplies start to dwindle, sheep producers will start looking at what to sell.

We know that sheep and mutton both have further potential upside, but it looks like there might be more upside in lamb.

Lamb prices averaged 10pc higher than current prices in May, June and July, while mutton values have rarely been higher.

Cast for age ewes are very good selling at the moment, as are lambs, but there is likely more upside in young stock than old.

What does it mean?

Strong mutton prices make selling decisions relatively easy this year.

Older ewes might have another 5pc upside in the meat market but lambs are more likely to rise further.

To conserve feed, any older ewes which are left can be cashed in, and efforts concentrated on finishing lambs or getting ewe lambs up for joining.

Young ewes are going to be the real winners when it rains.

Start the day with all the big news in agriculture! Click here to sign up to receive our daily Farmonline newsletter.