FROM a water supply crisis to bridging the gender diversity gap, 2019 has been a year when the processing sector has had to tackle numerous big issues.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

It's also been a year when margins have tracked well, allowing for plant investment and expansion, with processors no doubt looking to be in a position to capitalise on forecast ongoing growth in global beef demand.

The processing sector features alongside other red meat sectors in a 2019 wrap, Rare Vision, a liftout to be included in all the Australian Community Media agriculture publications next Thursday.

Strong offshore demand throughout 2019, particularly as African Swine Fever diverted swelling volumes of protein to China, and a favourable currency rate helped to keep processor margins above normal historical levels.

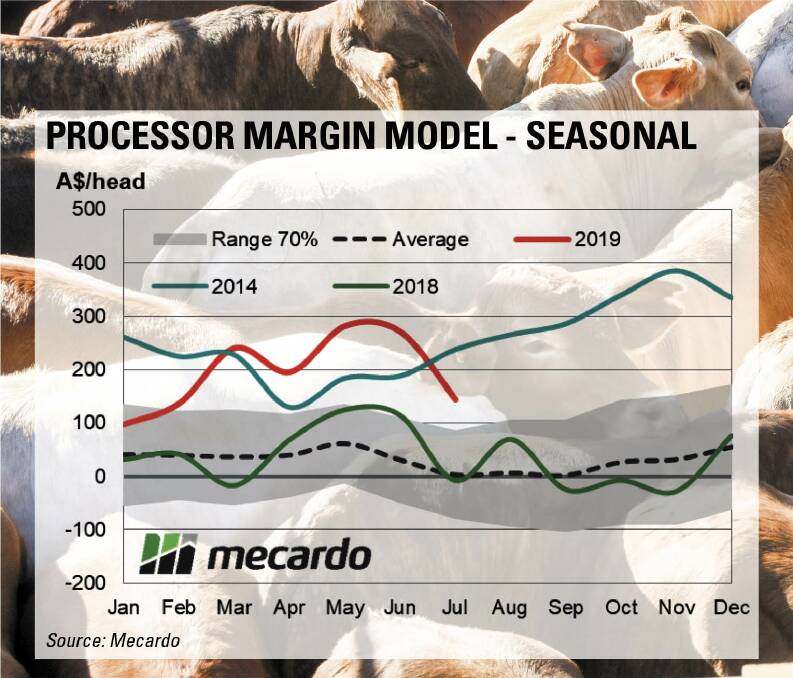

Combined with ongoing drought in Australia, which kept cattle prices in check, that strength in export prices meant on an annual basis meatworks were making an average $189 profit per head processed, according to analysis from Mecardo released in October.

However, 2019 has not been in the profit stratosphere processor reported in past droughts, and foremost on the minds of those running plants is the knowledge widespread rain will undoubtedly bring enormous cost pressure.

Given the high level of female cattle slaughter underway this season, supply is expected to be extremely tight when feed is available and restockers re-enter the market.

Discussion internally around what that may mean for beef production statistics is pointing to anything from processor shift cutbacks to complete plant shutdowns.

Still, the favourable dynamics at play in the four key markets underpinning Australia's beef export business - Japan, China, the United States and Korea - are setting a strong longer-term foundation and lifting optimism in the sector.

Chief executive officer of the peak processor advocacy body, the Australian Meat Industry Council, Patrick Hutchinson, said price stabilising on the domestic market had also been advantageous for the sector.

"Where differentiation of retail butchers from others in the market is happening - artisan bespoke butchers - we are seeing better margins," he said.

Mecardo has forecast processor margins to improve further over the final quarter of 2019, to hit an annual average close to $200.

Analyst, Matt Dalgleish, said margins would stay strong until the decent turn in the season arrived and the herd was tipped back into rebuild.

Big ticket items

The red meat processing sector ventured into water crisis lobbying during 2019, calling for government support to counter the devastating impacts of drought on regional towns where abattoirs are linked to public water.

Meat processing is a major employer in towns on the cusp of serious water shortages, such as Tamworth, Dubbo and Warwick.

"Without water, these businesses can't run, and that means jobs are in peril," Mr Hutchinson said.

Regular big ticket items for the processing sector, including trade relationships, technical barriers to trade and compliance, continued to be at the forefront of advocacy efforts for the sector.

In September a memorandum of understanding was signed with the China Meat Association, designed to maintain and enhance Australia's relationship with this essential partner.

Big strides were also made on labour with AMIC launching an Australian arm of the global Meat Business Women, an initiative aimed at shaping the landscape of the red meat game to make it attractive to female talent.