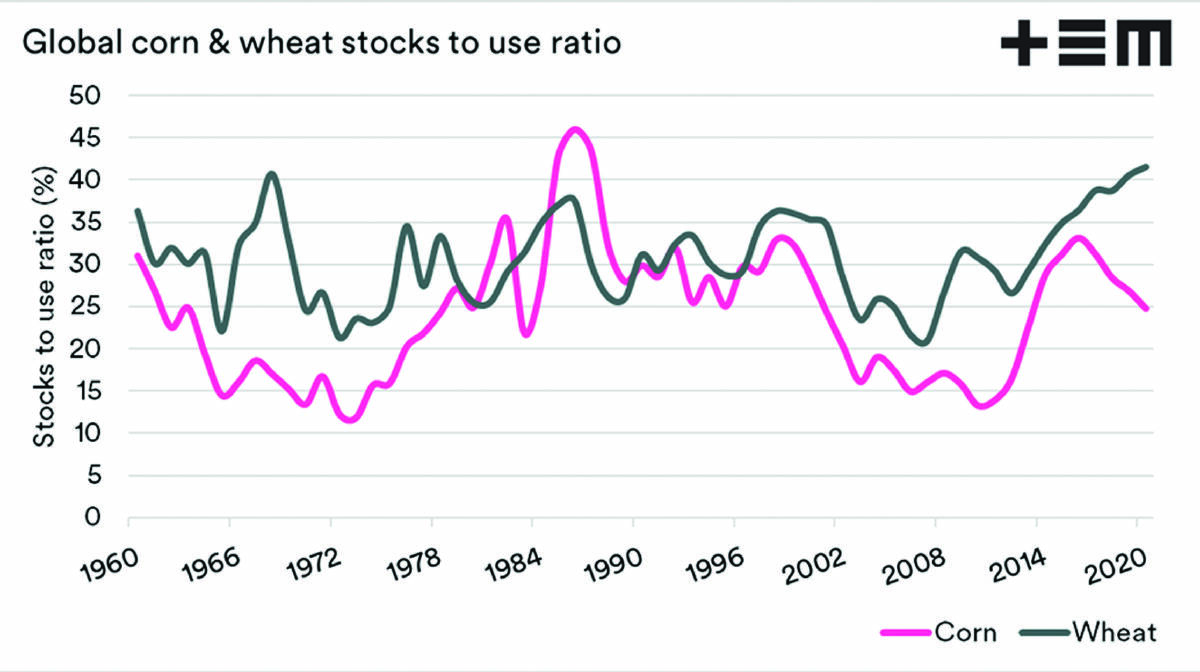

THE stocks to use (STU) ratio is a crucial barometer which is used to provide an insight into the relationship between supply and demand.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

The higher the ratio, the better supplied the world is.

As an example, in the chart opposite, wheat is at 41.5 per cent.

This means that the world has enough wheat in stores to meet 41.5pc of a year's demand in theory.

I have displayed the STU for wheat and corn together, as they tend to have close relationships.

In recent years we have seen the STU of wheat increase dramatically, due to years of record production causing large stockpiles.

It is important to note China's wheat position, as this has a significant impact on the overall picture.

The reality is that wheat has a very comfortable STU, even bearish when viewed globally.

The corn picture, however, has seen a downward trend in comfort.

At present, the corn STU is at 24.8pc.

Biotechnology has seen healthy improvements in yields; the usage has also considerably increased from energy to industrial purposes.

The fall in production has resulted in the supply/demand picture being markedly tighter.

Corn and wheat have a close relationship.

They tend to move in lockstep with one another.

At present, this is good, because the corn market is lifting us up.

If our wheat market traded in a bubble, we would see much lower prices.

As corn prices rise, we may start to see some demand destruction.

However, fundamentally prices are currently set at reasonable levels for the coming months.

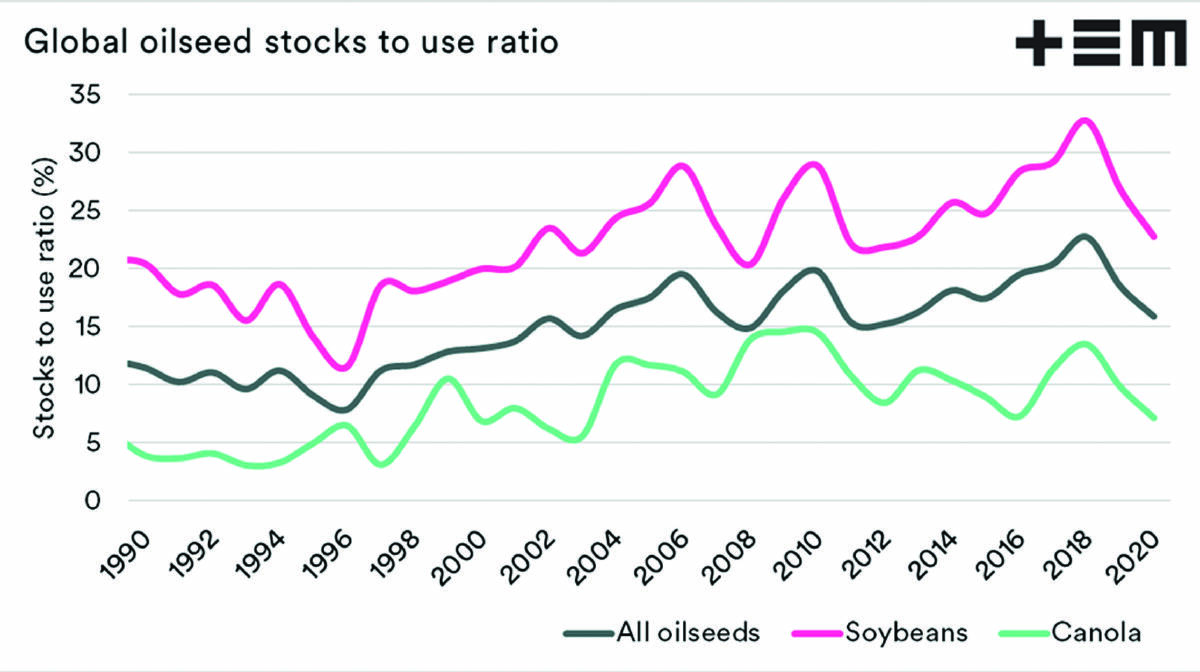

The stocks to use ratio for combined oilseeds, soybeans and canola, reached a very healthy level in 2018.

In fact, the peaks for the decade.

Since then, the STU has declined and is now at levels which are very supportive for higher pricing levels.

The reality is that La Nina can impact oilseed production in South America, which could mean that STU could stay lower for longer.

This would prompt higher oilseed prices for some time.

- More information: thomaseldermarkets.com.au