Fonterra has reported a massive 170 per cent jump in profit to a record $NZ1.6 billion ($1.47 billion).

But the giant New Zealand co-operative has cut the farmgate milk price paid to its New Zealand farmers.

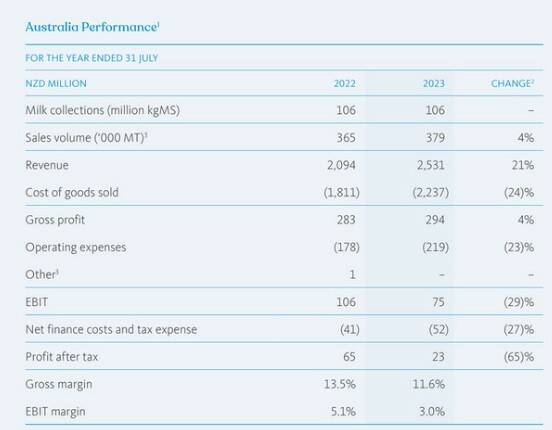

Its Australian arm recorded a 65pc drop in profit, despite revenue growth.

Fonterra chief executive Miles Hurrell announced the 2023 results on Thursday, September 21.

He said the co-op had delivered strong earnings and made progress against key strategic initiatives in the past year.

But he acknowledged this was against the backdrop of a farmgate milk price reduction for its NZ suppliers.

Fonterra's final farmgate milk price for 2023 is $NZ8.22 ($7.57) a kilogram milk solids, down from a record $NZ9.20 ($A8.48/kg MS) last year.

"Our 2022/23 season farmgate milk price was impacted by reduced demand for whole milk powder from key importing regions," Mr Hurrell said.

"As the financial year progressed, we saw Global Dairy Trade prices drop, with the average whole milk powder price down 16pc compared to last season."

But Mr Hurrell pointed to the full year share dividend of $NZ0.50 ($0.46) per share to farmer owners and unit holders, including interim dividend of 10 cents ($0.09) per share.

The co-op also returned tax free $NZ0.50 ($0.46) per share to shareholders and unit holders in August, following the divestment of it Chilean business Soprole.

Mr Hurrell said this gave a final cash pay-out to farmers of $NZ9.22 ($8.50) per share backed kg MS.

Australian business revenue up

The Australian business achieved another year of growth, despite challenging conditions.

Sales volumes were up 4pc and revenue up 21pc to $NZ2.5 million ($2.3 million).

But profit after tax was down 65pc to $NZ23 million ($21.9 million), due in part to a 23pc lift in operating costs.

Fonterra said it had faced significant challenges in Australia, including volatile economic conditions, inflationary pressures for consumers and farmers and a declining Australian milk pool.

Effective portfolio management in the ingredients business, leveraging high global commodity prices, combined with effective price management in consumer and foodservice, had helped offset significant inflationary pressures across the business, it said.

The Australian arm's consumer brands business continued to grow in market share during the year.

Operating expenses were impacted by one off-costs of $NZ27 million ($25 million) relating to the class action settlement agreement with Fonterra Australia milk suppliers in relation to the 2016 milk price clawback.

Rate increases on borrowings led to higher net finance costs.

Fonterra held its Australian milk collection at 106 million kilograms of milk solids, despite the declining Australian milk pool.

But that declining milk pool led the company to paying a record-high milk price to Australian farmers, which impacted on earnings.

Overall performance driven by cheese and protein

Mr Hurrell said there were a number of key drivers that drove the overall profit boost.

This included favourable margins in the ingredients channel, in particular, cheese and protein.

"We also saw improved performance in our foodservice channel due to increased product pricing and higher demand as Greater China's lockdown restrictions started to ease from the start of calendar year 2023," he said.

"Further, across the second half, the operating performance of our consumer channel strengthened due to improved pricing."

Want to read more stories like this?

Sign up below (select Dairy News) to receive our e-newsletter delivered fresh to your email inbox twice a week.