Sheep producers could be opting to market their lambs via direct over-the-hooks avenues rather than selling through the saleyards.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

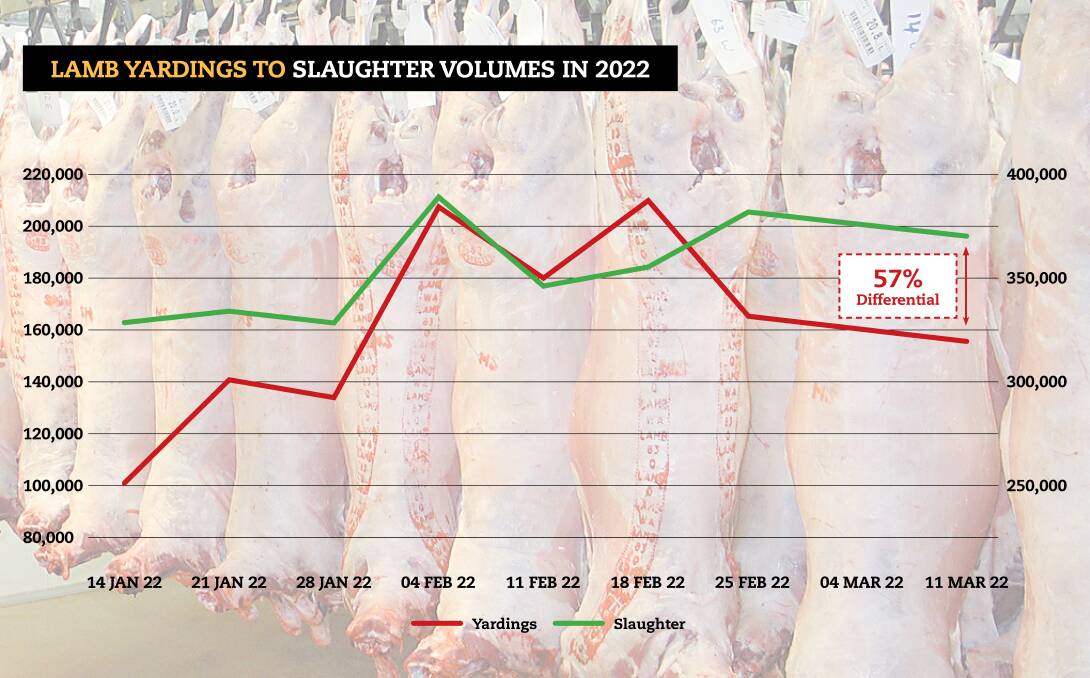

And the gap between lambs sold at the saleyard and lambs processed has reached its widest point since late January.

This is according to Meat and Livestock Australia (MLA) who say recent data reveals softer prices in the saleyards have a part to play in producer's selling decisions.

"For the last four weeks there is a discrepancy between the number of lambs yarded to the number of lambs processed," MLA market information analyst Ripley Atkinson said.

"Admittedly, not all lambs sold through the saleyards will enter processing facilities, but the discrepancy between lambs yarded and lambs processed is significant."

Mr Atkinson said last week, the National Livestock Reporting Service (NLRS) yarded 157,419 lambs, while the slaughter report showed that 365,390 lambs were processed.

"But this trend has been observed over the past four weeks from the week ending Friday February 18 and has gradually widened since then," he said.

"The data illustrates there is a national discrepancy between lambs sold at the saleyard and lambs processed, which could demonstrate producers are choosing to market their lambs via direct over-the-hooks avenues rather than sell through the saleyards."

He said with saleyard lamb prices across the board operating in softer territory than what they were 12 months ago, the option for many producers to sell their lambs direct through over-the-hooks selling avenues is an attractive option.

"Saleyard lamb prices are tracking lower than what they were 12 months ago and producers subscribed to favourable forward contracts that were offered late in 2021," he said.

But Nutrien Ag Solution livestock manager at Wagga Wagga Peter Cabot said he doesn't believe there has been a major swing in over-the -hooks options and those larger numbers are simply from making up ground lost to Covid-19 impacts on processors early in the year,

"In this part of the world 30 to 40pc of all our lambs go direct to the works," Mr Cabot said.

"I would say there hasn't been a big swing to selling over-the-hooks. I think the numbers have started to come forward in both forms - over the hooks and in the saleyards."

He said some of the forward contracts from January and February, although now finished, spilt into March this year.

"This was because of Covid disruptions at meat processors they couldn't get them all killed on time," Mr Cabot said.

"Some of those forward contracts we were pushed back 20 days or more, but generally they have been about two weeks behind."

Thomas Elder Market analyst Matt Dalgleish said when the good contracts were offered late last year, a lot of producers jumped on the back of them.

"They were pretty good pricing levels, and it was only a matter of days and they got their fill. They got a fair few producers happy to go direct," Mr Dalgleish said.

"This could account for why they are going direct, at least until the middle of March."

ALSO READ:

In Goulburn NSW, Nutrien Ag Solution livestock manager Daniel Croker said the lamb space has been a stop-start scenario since the end of December up until now.

"It is certainly not overly populated, more of a lag catching up," Mr Croker said.

"It is a week-to-week bases and weather driven.

"There will probably be a little period somewhere, and it's hard to put a finger on it, where it will go the other way for a while because of delayed shearings, as well as weather induced delays to the industry.

"It would be scary just to sit down and go through how many lambs there are sitting in the paddocks compared to previous years.

"There has been a lot of lambs purchased this year to go back to the paddock whereas in previous years there hasn't been.

"That's probably delayed everything and then all of a sudden it hits at a certain period and then it will plateau out again."

Mr Atkinson said the data does reveal the autumn flush of lambs has well and truly entered processing facilities.

"As producers sell lambs, the slaughter figures year-on-year, as well as compared to 2020, demonstrate a significant uptick in lamb volumes over the past four weeks," Mr Atkinson said.

"This improvement is cognisant of a larger lamb cohort and the autumn flush coming online, after lambs had been retained over the last two months of 2021 and early 2022 due to COVID-19, transport and weather challenges."

Start the day with all the big news in agriculture! Sign up below to receive our daily Farmonline newsletter.