AS beef export volumes start to ramp up in line with a maturing herd rebuild, attention is increasingly being drawn to whether Australia will be able to fully capitalise on strong global meat demand in coming years.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

The fear is the labour crisis is now constraining processing to such an extent that Australia may find itself in the horrendous position of watching livestock back up in the system at the same time as key markets are crying out for more beef.

The sheer number and diversity of markets Australian beef exporters supply has provided a superb buffer to the price competitiveness challenges that have emerged as the cattle market at home has skyrocketed.

However, processors say they can see no change in their current limited demand for finished cattle - regardless of what might be playing out demand-wise overseas - given the inability to source labour.

Analysts and experienced producers say the extent of constrained processing ability in Australia is unprecedented and can only put downward pressure on the cattle market when the heat comes out of restocker buying.

ALSO SEE:

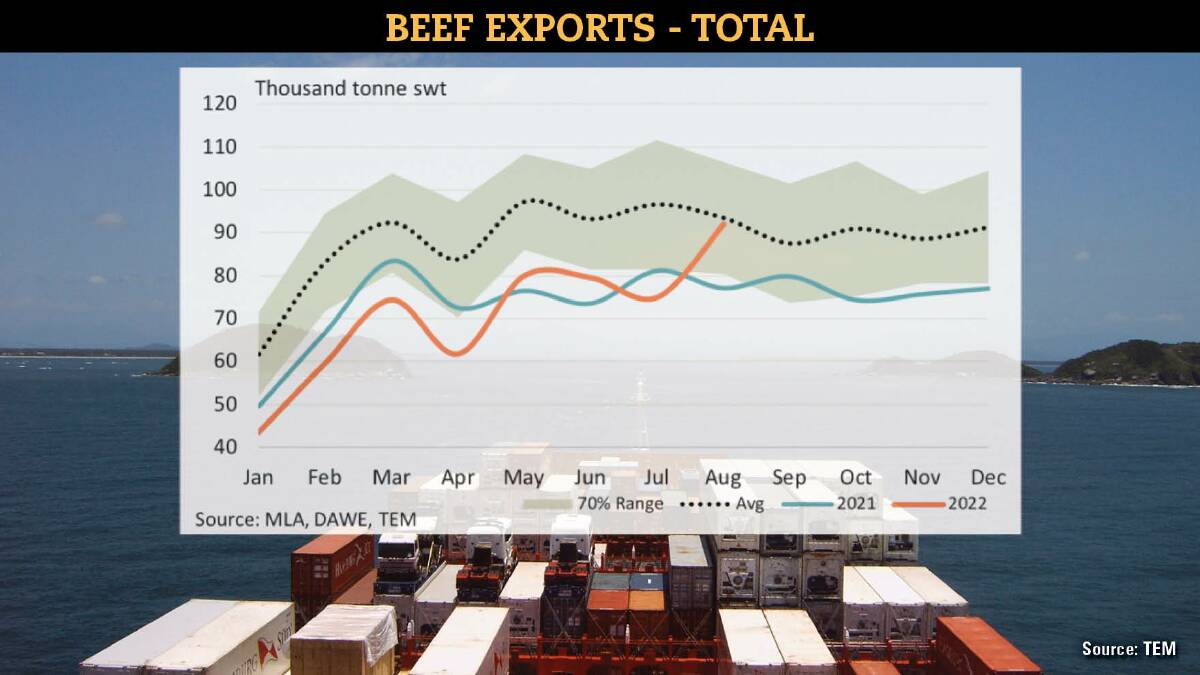

Beef exports jumped nicely in August, reaching 92,080 tonnes which Meat & Livestock Australia reported was the highest monthly total since June 2020. That figure was 23 per cent higher than the previous month and 19pc stronger than the year-ago level and has brought volumes shipped in total to a level just under the five-year average.

Analysts have listed a plethora of drivers for the lift, from changing trade quotas working in Australia's favour to ever-increasing animal protein demand out of China, but are quick to say it will take several months of heightened export volumes before a new trend can be called.

Still, as the herd rebuilds, higher export volumes will become more frequent, MLA business analyst Tim Jackson said.

"Beef exports rose in all major markets but increases were especially pronounced in SOuth Korea and China," he said.

Both those markets each accounted for 20pc of total volumes.

Thomas Elder Markets analyst Matt Dalgleish said the Korean consumer had been on 'a bit of an Aussie beef binge'.

Concerns about food inflation in that country saw the government suspend tariffs on a range of imported food products including beef.

The 18,386 tonnes of Aussie beef shipped to South Korea in August was the second highest month on record, Mr Dalgelish said.

There was no doubt Australian beef was high-priced on the global market but where that affected demand depended on the market, he said.

"On the commodity side, we were getting trounced by Brazil up until the middle of this year- especially into the US," Mr Dalgleish said.

"But they are now outside quota and for the rest of the season Brazilian beef into the US will attract a 26.4pc tariff, thus the uptick in flows from Australia over August. This points to a stronger end to the year for our exports into the US."

The potential in markets like the US, and the fact global beef prices remain historically strong, will make an inability to process beef all the more painful should cattle supply start to increase dramatically.

Consultant Steve Martyn said while labour in the processing sector had been an issue going well back, it was now extremely limiting.

It had become clear the sector's labour needs simply could not be met from the Australian workforce, he said.

Lessons could be learned from the US situation where the pandemic meant the labour was not there to process big numbers of cattle coming onto the market due to drought.

The result was livestock prices pushed right down at the same time retail prices were going up due to growing demand, as described by Tyson Foods' boss Donnie King in a US senate committee inquiry.