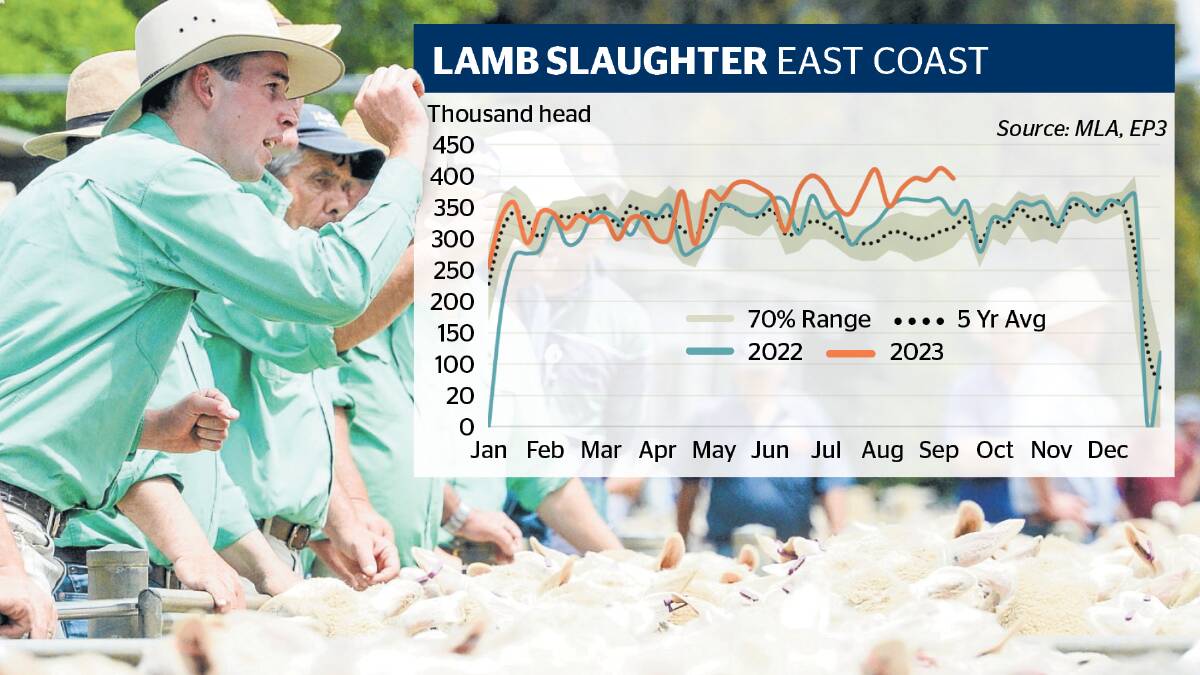

Prices are continuing to slide sideways in the sheep meat market, despite weekly lamb slaughter volumes over the past eight weeks running 28 per cent above the five year average.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Volumes have been 12pc above volumes processed over the same time last year.

Episode 3 markets analyst Matt Dalgleish said east coast processors are operating at around 80 to 85 per cent capacity but it's still not enough to clear the volumes of sheep and lamb coming onto the market.

"Mutton's been quite high for most of the year but the last two months or so lamb has moved up as well to reasonably high levels, demonstrating that obviously the processing side of things are doing their darnednest to work through this backlog, but it's still really not alleviating the price pressure," he said.

"The bulk of the spring flush don't start to come through from November onwards but we've just started to see Victorian yardings for lambs start to lift the last week or so, so that's the beginning of the spring flush.

"For the next two months that's just going to continue to climb and by the time we get to November, we'll be heading to 100,000 head of lamb or more being presented each week in Victorian saleyards."

Mr Dalgleish said he didn't expect to seem the same magnitude of price fall usual in spring because the market correction had already occurred.

"If you look at the export side of things, we are still seeing some quite good demand, whether it's lamb or mutton," he said.

"As long as the export market holds up, then I think there will still be some price pressure, but not the same level of price pressure we see when we're coming down from high levels through winter.

According to Meat & Livestock Australia, sheep slaughter the week before last rose by 5,680 to 160,165 head, while lamb slaughter fell by 16,791 to 447,022 head.

Slaughter is now consistently above the 2019 weekly slaughter average and close to the 2017-18 average.

A three-week shutdown for routine maintenance at TFI's Tamworth plant will add further pricing pressure at a saleyards level.

Livestock agent Ross Ellis, based in Warwick, QLD, said the scheduled shutdown had been well-advertised but would naturally have an impact on an already tough market in coming weeks.

"It will make a difference but there are still other processors and provided the numbers stay within reason and we don't have an offload [it should be ok]," he said.

"The reason why people are offloading is they're starting to worry about (a), getting supply of feed or (b) or they can see markets sliding so they don't want to get caught the same as the cattle market.

"There isn't a lot of confidence and it's scary.

"It's the relative newcomers to the industry that have been in the last five to 10 years where it's been above normal, they're the ones that feel it the most.

"The ones that have been around for quite a while, they know the wheel turns."

Mr Ellis said if there was a sudden change in seasonal conditions, a lot of problems would be alleviated as more producers held back stock.

"The other thing is you can't bale it, you can't put it in a shed, once the livestock is ready, you have to sell it," he said.