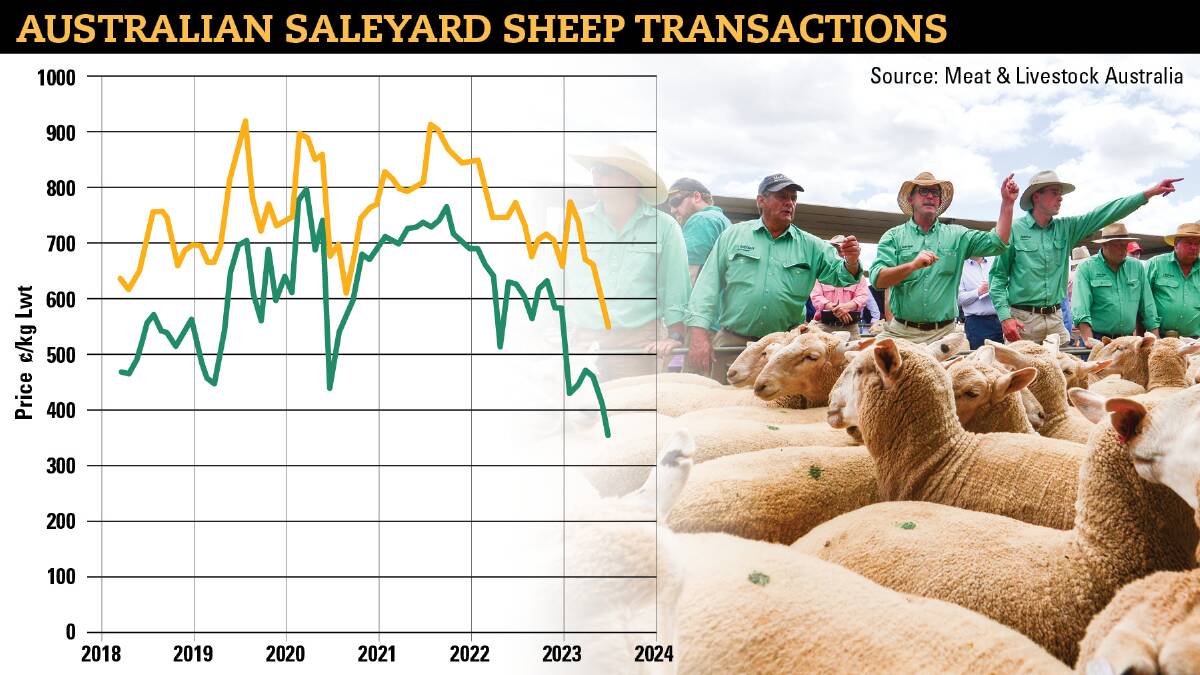

Lamb and mutton prices have had a slight bump following good rain across the southern regions, giving hope that low market confidence might ease.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Yardings eased last week with sheep numbers at 63,587 head and lamb at 133,189 head.

Heavy lambs lifted 5c week-on-week to 624.88/kg (carcase weight), with Wagga Wagga contributing 25 per cent of the indicator's throughput.

The trade lamb indicator improved by 47c after a 117c jump in prices at Hamilton, which contributed 11pc to the indicator.

Prices in the indicator increased across all weight ranges, with the heavier lambs from 24-26kg taking out a premium.

It comes as processors remain at capacity, with sheep slaughter reaching its highest level in Victoria in more than three years at 210,902 head.

Mutton, lamb and goat continue to compete for kill floor space, with goat slaughter lifting to 44,463 meaning a slight softening in sheep and lamb slaughter.

Episode 3 market analyst Matt Dalgleish said normally at this time of year, dwindling supply has a positive effect on price but it seemed that producers were still trying to offload stock.

"There's still a lack of confidence at the market at the moment," he said.

"It's a pretty uncharacteristic trend for this time of the year to see the prices continuing to slide... I'm of the opinion still that it's a bit overdone at these levels.

"I'd personally think that at any stage now we could start to see it grind higher.

"Any time from now onwards we should start to see that market tighten up in terms of the availability of product and that's usually the catalyst for prices to start to climb.

"It could happen in the next few weeks."

Mr Dalgleish said the Bureau of Meteorology three-month forecast tipping below average forecast could be one factor adding to the lack of confidence.

"People could be recalling the dry 2019 we saw and they don't want to get caught holding too much stock at the moment," he said.

MORE READING:

Total lamb export volumes from Australia increased over May to 28,518 tonnes, a 28 per cent gain from April.

It was the strongest monthly shipment of lamb exports since May 2019 when 29,540 tonnes were consigned, with current lamb export volumes 10pc above the five-year average trend for May.

Mr Dalgleish said the export figures were very positive, though mutton continues to outperform lamb on the world stage.

"We had our highest tradable month for the year over May in terms of lamb flows," he said.

"It does tend to peak in May anyway in terms of those strong export numbers seasonally but there's no real signal from offshore markets that there's a lack of demand for product."

May saw lamb exports to China rise 40pc to reach 7,196 tonnes swt, a volume 17pc above the average seasonal pattern for May, based on the five-year average.

The month also saw lamb export volumes to the USA gain some ground, lifting by 38pc from April levels to reach 5,297 tonnes, 5pc below the five-year seasonal average.