Individual bankers who have done the wrong thing should be punished but Australia doesn't need its system "gummed up" with excessive regulation, Tony Abbott is warning ahead of the banking royal commission revealing its recommendations.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

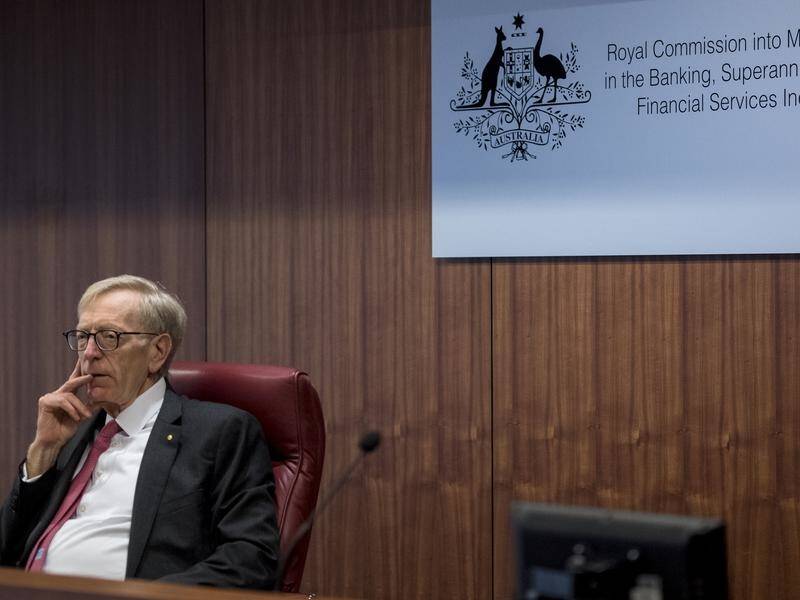

Banks and the wider financial services industry are bracing for a scathing final report from royal commissioner Kenneth Hayne QC, which will be released after the share market has closed on Monday.

Having already condemned the industry's greed and criticised weak regulators for letting misconduct go unpunished, Mr Hayne will recommend substantial changes across the banking, superannuation and financial services industry.

Opposition Leader Bill Shorten says he feels vindicated in having pushed for more than two years for the commission to take place.

"The victims and consumers and people who believe in having an honest and ethical banking sector, we'll keep being in their corner and we'll make sure this government does not backslide on the banks," he told reporters in Tasmania.

"It's a day of reckoning for the banks and financial institutions who have abused the trust of literally thousands of their customers."

Labor's financial services spokeswoman Claire O'Neil says an apology from the banks won't cut it.

"The time for heartfelt apologies from the banks is over now. What we need to see is the banks themselves come forward and say they support what is going to come out of this royal commission," she told reporters in Canberra.

Mr Abbott said the inquiry had exposed horrific conduct by banks and their staff and that should not go unpunished.

But that didn't mean the whole system was rotten, he added.

"In this era when no one ever takes personal responsibility for anything, when something goes wrong we assume it's a systemic fault as opposed to an individual's fault," he told 2GB's Ray Hadley on Monday.

"What I don't want to do is to see the system gummed up by a whole lot of additional regulation rather than see the people who have actually done the wrong thing being appropriately punished."

He cautioned against a "royal commission-induced credit squeeze", echoing calls from Prime Minister Scott Morrison last week, who said bank loans were the lubricant of Australia's economy.

Influential Senate crossbenchers Pauline Hanson and Derryn Hinch said criminal charges should be laid against those found to have done the wrong thing.

"Somebody has to face criminal charges here because some of the actions were absolutely unconscionable," Senator Hinch told Seven's Sunrise program, while Senator Hanson said there should be jail sentences.

Meanwhile, several of Australia's banking chiefs, including ANZ boss Shayne Elliot and NAB acting chief executive Gary Lennon, will hit the streets to sell copies of The Big Issue during the week.

The street magazine is traditionally sold by homeless and marginalised people, who get to keep half the cover price from each sale.

Australian Associated Press