Landmark says it will not enforce its existing business template on Ruralco management when the planned merger goes ahead later this year.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Rather, it wants to adopt a "best of breed" business structure drawn from both farm services companies when their management and support systems are combined under one re-named corporate brand in the second half of 2019.

Nor will there be widespread store closures in regional locations where both Ruralco and Landmark business units already exist.

"We won't be using Landmark systems and processes if we can see better options already working at Ruralco, or elsewhere

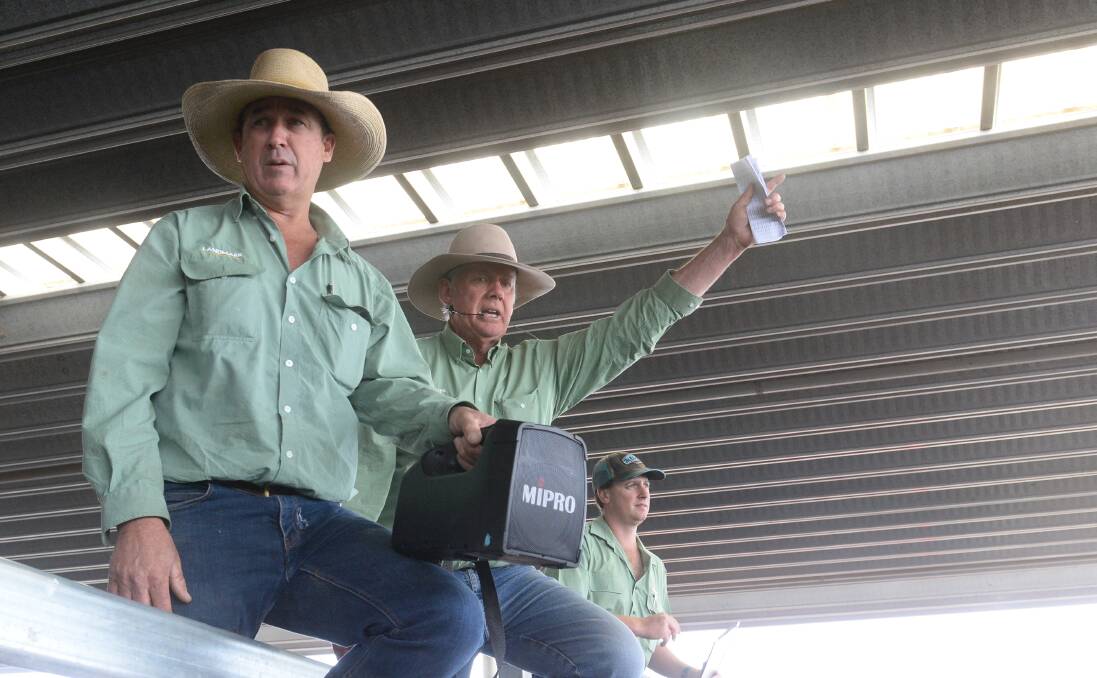

- Rob Clayton, Landmark

"We are looking at a best of breed strategy we want to deploy," said Landmark managing director, Rob Clayton.

"We certainly won't be using Landmark systems and processes if we can see better options already working at Ruralco, or elsewhere."

Integration plans

An integration process led by Ruralco's strategy and development general manager, Tim Higgins, and Landmark's north eastern regional director, Robert Payne, was exploring which Ruralco businesses were likely to stay largely unchanged, or how the merger may define how the two companies' different sites were used in their shared marketplace.

For example Ruralco's 11-store South Australian-Victorian joint venture, Platinum Ag Services, would continue operating under its existing brand name with no obvious changes to the extensive range of services offered to its customer base.

Landmark businesses in the same localities would remain as a competitor (under a new name), retaining their customer portfolio.

But both business groups would benefit from the new parent business' balance sheet cost savings in back office areas such as treasury, human resources, intellectual property, marketing and payroll, plus access to a bigger fertiliser, crop chemical and merchandise product base.

Platinum's footprint stretches from Mildura in north western Victoria to SA's Yorke Peninsula.

Like many of Ruralco's independently branded businesses, it has services extending from livestock marketing to insurance, rural merchandise, water equipment and agronomy advice.

Doing things differently

"Platinum and Landmark are doing different things in that marketplace and we think we can deliver a higher level of customer service after the merger by them remaining as separate entities," Mr Clayton said.

"Putting one and one together would only equal 1.5."

Ruralco's house brand agricultural chemical product range, Relyon, will continue selling in outlets not operating under the new corporate banner, while Landmark's Genfarm range will be available through remaining retail channels.

All locations in the combined network will have access to Loveland products made by Landmark's North American parent company, Nutrien.

Locally registered crop inputs from the Loveland range are already sold by Landmark.

They will become part of the Relyon offering in stores not carrying the new corporate brand name.

The CRT business will stay a transparent model, so if procurement and management costs come down the savings will be passed on

- Rob Clayton, Landmark

Ruralco's big Combined Rural Traders (CRT) merchandise wholesaling and retail division will not change its business model and will continue to be led by current executive general manager, Greg O'Neil.

"However CRT will get all the benefits of the company's bigger buying power, as well as savings from combining the Landmark and Ruralco business costs," Mr Clayton said.

"The CRT business will stay a transparent model, so if procurement and management costs come down the savings will be passed on to businesses in that network."

Mr Clayton said the new company's restructure and cost savings would take time to bed down on a locality by locality basis, however job cuts would be contained to "non-customer facing roles" and were unlikely in the bush.

RELATED READING:

"Both businesses operating in a town will still have their local people, including admin people - we need to be sure our businesses stay focused on engaging with customers," he said.

"Our game plan is not to lose one customer."

He said in some cases the changes may see existing Landmark and Ruralco sites in regional centres re-purposed to handle specific business activities, but those changes should not alter total staffing arrangements.

However, Mr Clayton acknowledged not all current Ruralco partners, CRT members and staff may wish to stay after the $469 million Landmark takeover.

Myths debunked

"It's up to them to decide what they want, but I think we've debunked the myths about Landmark," he said.

"Our business does its own decision making in Australia, our people aren't under a corporate controlling thumb or tied to some micromanagement routine."

While some talk of pre-merger staff and client departures was already circulating in the industry, Mr Clayton said in reality, Landmark had actually gained new staff since amalgamation plans were confirmed last month.

"There's always a certain amount of churn and movement between businesses like ours or Ruralco or Elders, so it's no surprise if people move on to new jobs, but I can absolutely confirm we've gained staff," he said.

"In fact, Landmark hired 255 people in 2018 - there are a lot more people working for this company now than when I started in this role a year ago."

- Does this article interest you? Scroll down to the comments section and start the conversation. You only need to sign up once and create a profile in the Disqus comment management system for permanent access to all discussions.