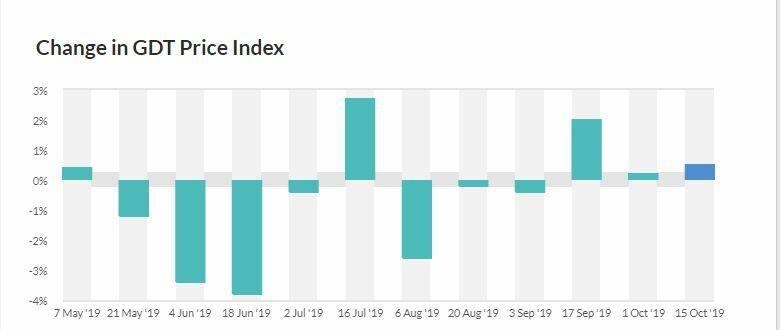

International dairy commodity prices have inched up this week as production and consumption signals suggest further upward pressure on markets in coming months.

Subscribe now for unlimited access to all our agricultural news

across the nation

or signup to continue reading

Global Dairy Trade's auction in New Zealand saw overall price index lift 0.5 per cent, led by a 3.6pc jump in casein values and a 2.4pc lift in skim milk powder prices to $US2743 a tonne.

Cheddar, however, dropped 2.2pc to $US3,636/t and butter prices slipped slightly (0.4pc) to $US4,105/t, while whole milk powder remained stable at a weighted average price of $US3133/t, despite futures markets predicting a 1pc rise.

"Fortunately for dairy producers global dairy prices remain relatively resilient in the wake of the increasingly shambolic geo-political backdrop and slowing global growth," said senior rural economist with NZ bank, ASB, Nathan Penny.

While China, the world's biggest dairy importer, had a slowing economy and a weaker currency as a result of the snowballing US-China trade and tariff tit-for-tat, he said householders were still spending relatively strongly on food.

"The relative strength of the Chinese household sector appears to be a key factor underpinning global dairy prices," he said.

Chinese bidders made up the biggest group participating in this week's dairy auctions, with China's auction demand up slightly to around 55pc of total sales volume.

South East Asia-Oceania buyer activity retained a steady 27pc share.

If our production forecast proves close to the mark then global dairy prices are likely to firm over the remainder of 2019

- Nathan Penny, ASB

Another important factor influencing the market has been tighter supplies of milk, particularly in the EU, US and Australia.

Mr Penny said while NZ farms had delivered almost 4pc more milk in July and August than in 2018, ASB still expected total 2019-20 production to be no different than the previous season, with recent evidence indicating slowing spring production.

"If our production forecast proves close to the mark then global dairy prices are likely to firm over the remainder of 2019," he said.

RELATED READING:

Westpac's head of NZ strategy, Imre Speizer, agreed global supplies remained constrained and were pushing futures markets to consistently predict moderate gains in GDT auction prices.

In NZ, the biggest influence on global milk supplies, mixed seasonal conditions in September and October had seen soil moisture conditions about average, but temperatures in the South Island were colder than average, hampering pasture growth.

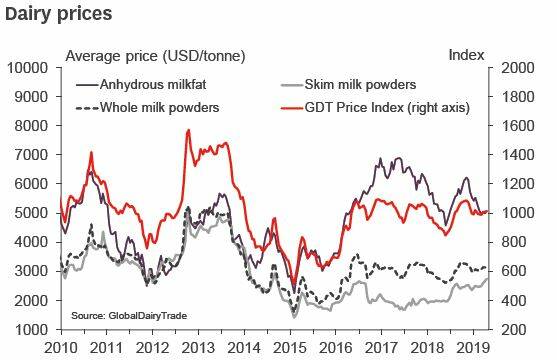

Industry analysts anticipate firmer SMP prices as surplus EU stocks fall, coinciding with gradually firming butterfat values as demand improves in Europe and developing markets.

Global Dairy Trade's latest SMP annual index is up 38pc, compared to 15.4pc for whole milk powder.

Although, global demand growth was slower, past buying trends suggested more capacity for powder demand from South East Asia and Chinese demand for SMP was expected to remain the same over the coming months.

- Start the day with all the big news in agriculture! Click here to sign up to receive our daily Farmonline newsletter.